Photo source: Getty Images

I am not only interested in profit revenues in the short term when I buy stocks to get a negative income. I would like profits that can provide large and growing profits over time.

As this table appears, Greencoat UK (LSE: UKW) It is expected to be impressive in both charges during the next few years:

| year | Distribution of profits for the share (expectations) | Profit |

|---|---|---|

| 2025 | 10.38p | 8.6 % |

| 2026 | 10.70p | 8.8 % |

| 2027 | 11.01p | 9.1 % |

It is important to remember that distributed profits are never guaranteed. Moreover, the city’s expectations (to which these returns are based) can shoot both below and above.

However, I am sure that this star profits offer a second long -term income for investors. If the expectations are accurate, a cut amount of 10,000 pounds today will provide profits of 2,653 pounds between now and 2027 alone.

Here’s why I think about FTSE 250 A company for my private wallet.

Good and bad

Renewable energy shares contract can sometimes be a problem. When the sun does not shine or the wind does not blow, profits can stumble as energy generation decreases, which may affect profits.

This is a constant threat to Greencoat UK, all its origins in Britain, as its name suggests. However, this most tight geographical imprint has its advantages.

Britain is famous for excellent wind speeds and long coasts, often the window of wind abroad exceeds 50 %, making it one of the world’s leading places to build turbines. The ability of future wind farms tends to an increase of up to 65 %, with technology improvement.

The UK has also become one of the most supportive environments in the world of green energy. Last Friday (July 4), the government announced new plans to charge the ground wind industry through steps such as simplifying the planning process and increasing supply chains.

When doing this, the government looks forward to almost the total wild wind capacity, to 27gw-29GW by 2030.

I am the hero of profit I think of it

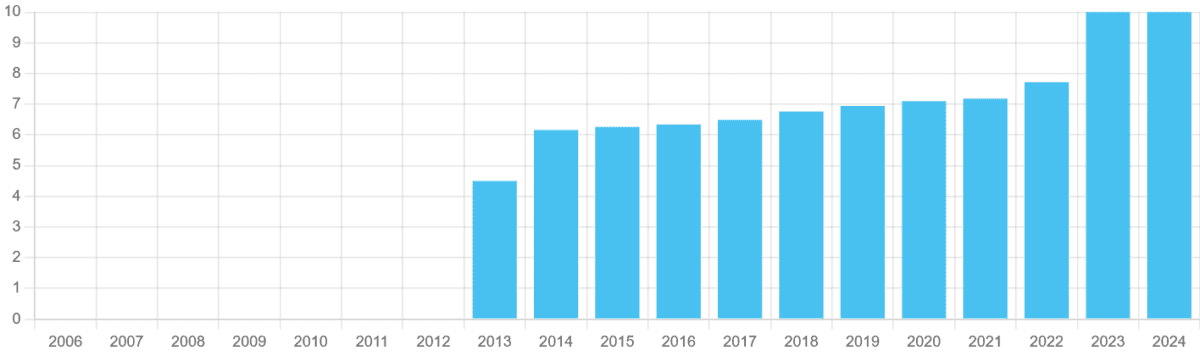

This provides an important field for Greencoat UK, which currently has 49 wind farms, to maintain the progressive payment policy. As you can see, the annual profits here are constantly increasing because they are listed in London Stock Exchange More than a decade ago.

The only exception came in 2024, when the company reduced long -term power generation expectations by 2.4 %, leading to a decrease in asset values. But with these changes made, the city analysts expect to start with higher profits again than 2025.

The drawing also emphasizes another attractive feature of renewable energy stocks like this. The demand for electricity remains generally stable during all economic conditions, even during the high inflation and the well -related well. So, while these companies can continue to produce energy, cash revenues and flows continue to intervene steadily.

Although it is not without risks, I am considering adding Greencoat UK to my own portfolio for a long -term income.