Photo source: Getty Images

Are you looking for the best growth shares for purchase? Here two of FTSE 100 and FTSE 250 Indexes to look next month.

Mining endeavor

As gold prices continue to rise, precious metal stocks require seriously in my book. FTSE 250 mines workers Mining endeavor (LSE: EDV) – which produces alloys from a group of African mines – is one for growth investors to consider.

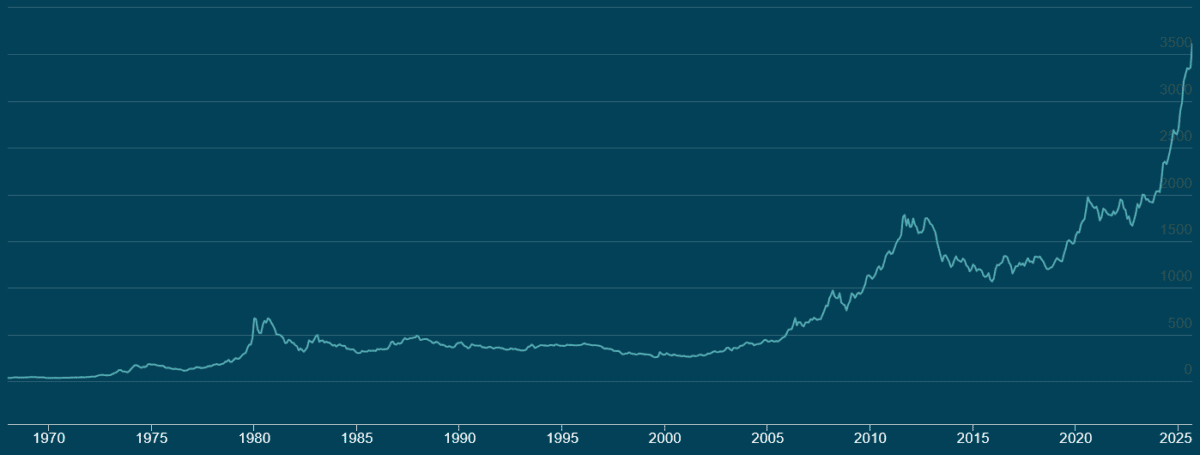

The yellow metal has increased by 44 % a year so far, as it touches new peaks of about $ 3800 an ounce in recent days. Nearly 40 daily standard levels were performed in 2025, as was almost last year. This confirms the strength of demand from both retailers and central banks.

This, in turn, has pulled the endeavor share price of 106 % higher during this period.

There is no guarantee that gold prices will continue to climb. The rapid printed gains in recent years can actually increase any decrease if the investor's morale changes.

Such a scenario can be especially fraught with endeavor and other mining shares. The profits of miners can rise more severely than gold and silver themselves during the bull markets, as well as the gains of the huge stock prices in Endeavor so far in 2025. But this phenomenon also works in the opposite direction, and can lead to a significant decrease in stock prices.

However, on the budget, I am sure that precious metals should gain them. The hopes of the discounts in interest rates in the US Federal Reserve recently strengthened prices, as well as fears of the independence of the central bank.

These factors-allied to the signs of global high inflation, the increasing conflict in Europe and the Middle East, and concerns about global growth-mean that many city analysts expect that the demand for safe goods will remain hot.

This reflects, Endavor Mining's profits are distinguished to 9 % year on an annual basis in 2025. An estimated 8 % increase for next year is also supported, while supporting expectations supported by company production operations. The group's output increased by 38 % between January and June, to 647,000 ounces of expensive metal.

Antofagasta

Gold is not the pillars of precious or industrial metals that travel in 2025. Copper prices increased by 15 % as well, which leads to withdrawing the price of red metal mining stocks such as Antofagasta (LSE: Anto) Skyward as well.

Unlike gold, copper prices are vulnerable to decline if poor economic indicators. However, prices are supported by the possibility of more cuts in interest rates by global central banks. I am sure that copper values can continue to progress, especially given the escalating display problems, including the suspension in the main mines such as Grasberg in Indonesia.

Antofagasta's share price increased by 56 % a year so far. As a result, it looks charged on paper with the price ratio to the profits (P/E) 33.6 times.

I think this evaluation somewhat reflects the company's exceptional growth expectations. City analysts believe that annual profits will increase by 51 % in 2025 and increase another 10 % in 2026. However, it should also be noted that the high P/E can leave Chilean miners vulnerable to decrease if copper prices reflected.

However, on the scale, I think this FTSE 100 participates calls for serious attention. I think the company can make an exceptional growth of the long -term profits, as rapid growth in SuperCashesheshesheshesheshees Global Copper demand.