Photo source: Getty Images

Low savings accounts for return, property, or modern business plans? In my opinion, the best way to target a long -term negative income is to buy profit distributions FTSE 100 Stocks instead.

Persus can occur, as we saw during the Covid-19 crisis when the trusted profits or the suspended payments are reduced. But to a large extent, the UK’s participation index remains a great place to target the second decent income, with the support of:

- Dozens of leading companies in the market that have strong barriers to enter.

- Companies in mature industries that restore more profits through profits.

- The presence of many defensive arrows (i.e. non -periodic).

- Companies with strong cash flows and controlled debt levels.

to lift

Looking at defense shares like BAE systems (LSE: Ba.) can be great ways to target the second increasing income. Their operations are not greatly affected by the broader economic conditions, which gives them strength and confidence to raise the profits that were whatever the weather.

The football player continued to increase cash rewards during the epidemic, confirming this flexibility. Defending the individual borders of external threats is the maximum priority for any country, which means that BAE systems products have a strong demand. In fact, the expectations here are stronger than for decades as the main European customers are returning quickly.

Of course, technology failure can be very harmful to future profits, which affects profits and company reputation. However, the strong roller record for the blue chip helps calm any concerns about this front.

Today the return of the front profits on the shares of Bae Systems is 2 %.

High -time

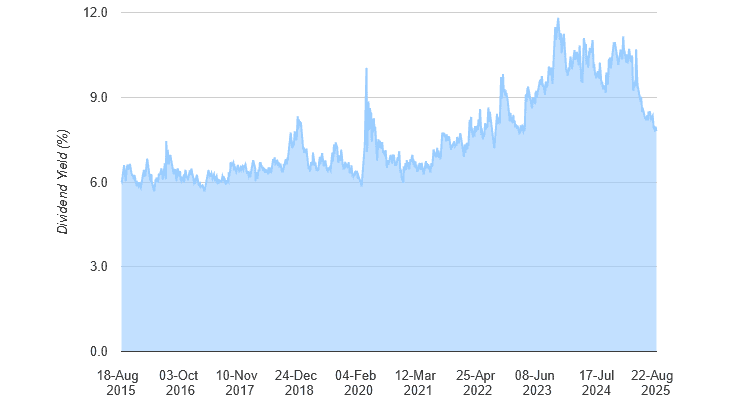

Phoenix Group (LSE: PhNX) has a long record of profit distribution offers higher than average, as the chart appears below. It has grown about a decade ago, and the city analysts expect this to continue in the medium term.

As a result, the profit return on Phoenix shares for 2025 is still enormous, by 8 %.

Simply put, the financial services giant is an impressive cash generator. Its share price may be disappointed when economic conditions are aggravated and the demand for financial services decreases. But the strong public budget means that this does not harm its policy of generous profits.

The share coverage rate for the shareholders was 172 % as of December. I expect the company to update the trading for a period of half a year (on September 8) to reaffirm its strong financial foundations.

The highest confidence

Tawheed Group (LSE: UTG) has been prepared to provide a large and reliable negative income for the shareholders. As a real estate investment fund, at least 90 % of rent profits should be distributed in the form of profits. This is in exchange for the advantages of exciting taxes.

Please note that the tax transaction depends on the individual conditions of each customer and may be subject to change in the future. The content in this article is provided for information purposes only. It is not intended to be, nor form any form of tax advice.

Such a condition does not buy irrational dividends. However, the UNITE focus on the highly stable student accommodation market makes it much more flexible than other real estate boxes (such as warehouse operators or owners of shopping centers).

There are risks here, such as interest rate pressures that can reduce asset values. However, I think the opportunities here exceed the risks, with the support of increasing numbers of foreign students and permanent lack of property.

The return on front profits here is 5.3 %. Like BaE Systems and Phoenix, I think confidence is worth serious study.