The data on the chain shows that the value of the Bitcoin market for the achieved value (MVRV) has formed a cross that can be considered a Haboodian signal.

Bitcoin MvRV has decreased under 200 days recently

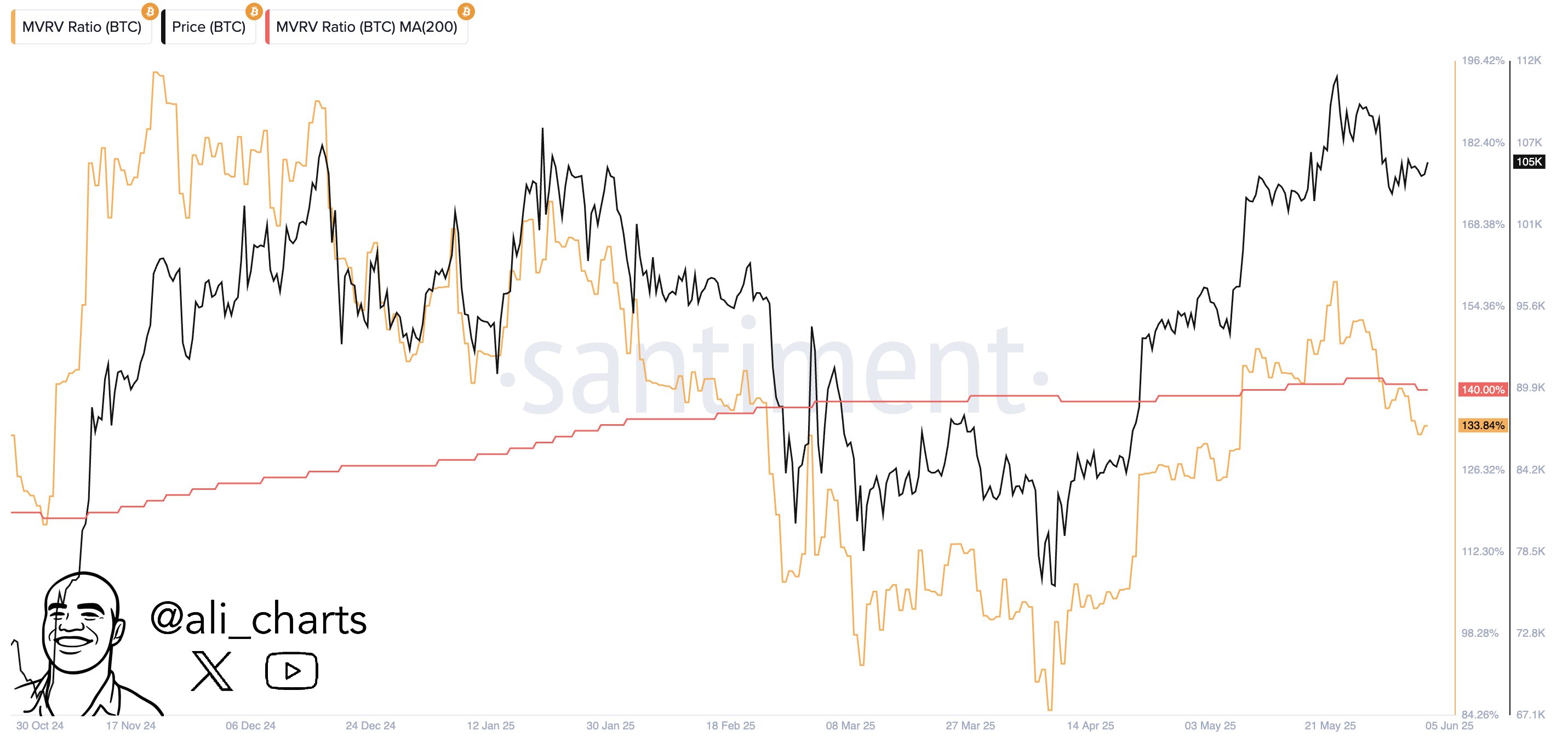

Analyst Ali Martinez also indicated in a new post on X, the percentage of Bitcoin MVRV exceeded a simple 200 -day moving average (SMA) recently. The “MVRV ratio” indicates an indicator of the series that measures the percentage between the maximum BTC and CAP market.

The maximum achieved here is a formal model for the cryptocurrency that calculates the total value of the original display by assuming the “real” value of each distinctive symbol equally with the immediate price that was last transferred to Blockchain. This model differs from the maximum of the usual market, which simply takes the value of all the symbols equal to the current instant price.

Since the last transportation of any currency is likely to represent the last time it has changed, the price can be considered mainly the current cost. As such, the maximum achieved is just a sum of the acquisition price for all traded symbols.

One way to explain the model is a measure of the total amount of capital that investors have placed in Bitcoin. On the other hand, the maximum market can be seen as the value that its owners hold at the present time.

Since the MVRV ratio compares the two models, it mainly tells us about the state of profit loss for investors as a whole. Below is the graph that the analyst who appears in this indicator, as well as SMA, shares for 200 days, over the past year.

The two lines seem to have gone through a crossover in recent days | Source: @ali_charts on X

As visible in the graph, the Bitcoin MVRV ratio was higher than a 0 % brand, indicating that the investors as a whole were sitting on a great profit.

The scale rose normally, as the asset rally increased earlier to the highest new level (ATH) and was able to overcome it to 200 days. However, recently, the landfill in the currency means that the indicator has retreated under the line.

The last time the MVRV ratio decreased below SMA for 200 days was in February. From the graph, it is clear that this intersection has proven to be a declining for the encrypted currency.

It remains now to see whether this type of intersection will end up proving another bad omen for Bitcoin or not.

BTC price

At the time of this report, Bitcoin is trading about $ 105,000, a decrease of 1 % last week.

Looks like the price of the coin has rebounded from its latest plunge | Source: BTCUSDT on TradingView

Distinctive image from Dall-E, Santiment.net, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.