Photo source: Getty Images

The state’s pension news is rarely outside the headlines. Do not speculate the future living levels of retirees, while emphasizing the importance of long -term financial planning with pensions or savings products such as individual savings account (ISA).

Britain is not alone in the face of the retirement crisis. The deterioration of public financial affairs, along with the advanced population, raises questions about how governments around the world are able to finance future pensions.

It is a realistic idea. But it is not too late to start building wealth to avoid financial hardship in subsequent life. Let me show you how a diverse box can help protect the financial future.

Warning warrants

Comments on Monday (July 21) from the UK government are tightening the specified time bomb facing the British today.

According to the research of the Ministry of Labor and Pensioners (DWP), retired persons in 2050 will be 8 % – or 800 pounds – worse than those who leave the workforce today.

To address this crisis, the government said it revived the retirement committee, which will work.Check the complex barriers that prevent people from saving enough to retire“But this is not everything – its role will also be.”Check the pension system as a whole and look at what is required to build a strong, fair and sustainable future retirement system“.

Moreover, another government review will analyze the age in which people can start demanding the state pension.

The current pension of 66 to 67 years is scheduled to rise between 2026 and 2028, and again to 68 between 2044 and 2046. But some economists and industry experts warn of these changes.

Targeting a negative income of 44 thousand pounds

I don’t know about you. But I do not want to put myself at the mercy of changing government policy. I want to retire in a decent era, and enjoy a comfortable living level when I do.

My plan is to build my retirement box with cash, stock, confidence and boxes, using a set of ISAS and self -invested Personal pension (SIPP). By giving priority to investing in the stock market, I think I can achieve an 8 % long -term annual average with risk management.

At this return price, the monthly investment of only 500 pounds over 30 years will create a retirement egg of 745,180 pounds. At this level, one can have an annual negative income of 44,711 pounds in retirement if it is invested in 6 % profit distribution stocks.

This is with the exception of any possible support from the state pension.

Wealth Building Fund

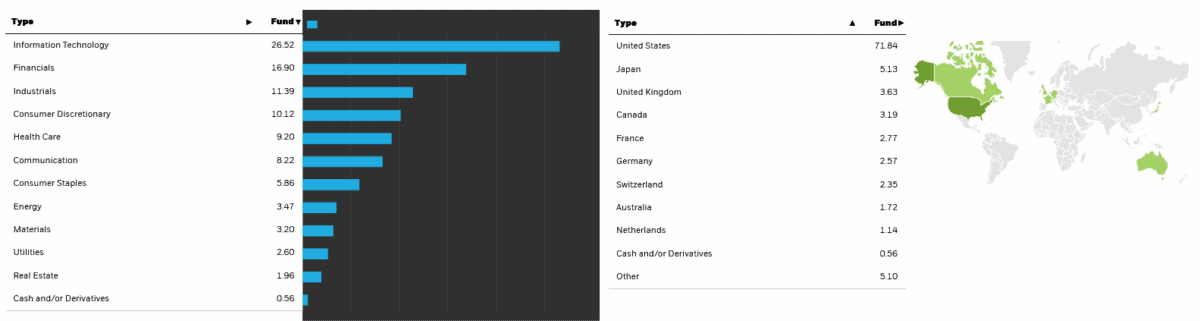

Global funds like Ishaares Core MSCI World Index (LSE: IWDG) can be strong weapons in helping me to achieve this. Diversification across regions and sectors provides excellent management of risks with no opportunity to make a change that has changed life.

In fact, this circulating box (ETF) has provided an average annual return of 10.9 % since its establishment in 2017.

Stock -based vehicles can provide such disappointing revenues while the market decline. But as the ISHARES box showed, in the long run, it can effectively absorb the capabilities of the stock market and provide great returns. The main holdings here include Nafidiaand AmazonAnd Berkshire Hathaway. In total, shares carry shares in 1,324 global arrows.

With exposure to strong growth sectors like them and financial services, I think this fund may remain an excellent origin. It is one of several money that I think is to demand serious attention.