Photo source: Getty Images

The conditions are still difficult FTSE 100 Building Ridro bratro (LSE: BTRW) as the British economy excels. In the first half, I reported the completion of 16,565, and its target scope of 16800-17200 has lost a noticeable distance.

To add more woe, it also remains affected by the expensive old construction defects. The additional obligations to property reserved 248 million pounds in January to June, due to the safety of fires and structural issues in previous developments.

At 373 points per share, FTSE is now trading with a 32.8 % discount for what was 12 months ago. Despite construction problems, I think this may be an opportunity to buy an attractive decline.

In fact, the city analysts believe that the price of the Barratt shares can be exported about 40 % during the next year.

Recovery continues

Although the company’s recovery is slower than he was hoping, he is still moving forward. The pure private reservation rate increased by 16.4 % between January and June, to 0.64 per port per week. I also mentioned that the front application book was “was”Keep: This has increased 10.5 % and 4.3 % based on value and size, respectively, in the first half.

Doubt remains if bars can continue to recover, but I am optimistic. Useful interest rates will continue to decline with decline in inflation and support for the purchase costs.

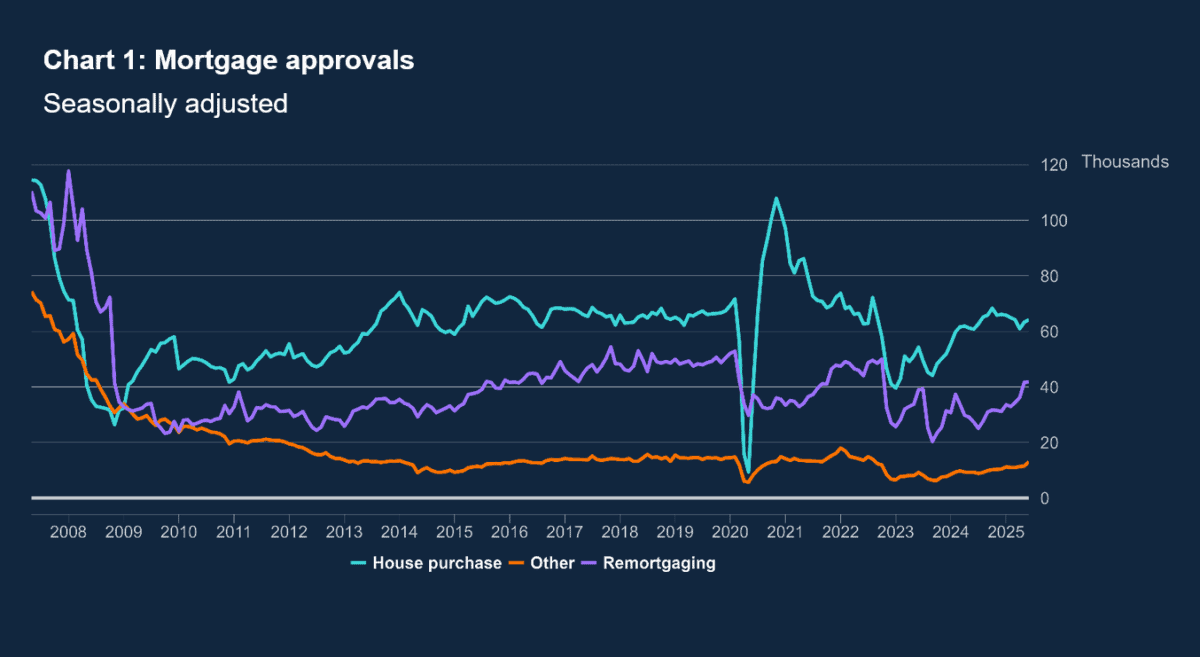

In confirmation of this support, the latest bank’s bank data showed net real estate mortgage approvals to buy homes by 1.4 % per month in June.

Discounts in future prices can also be fed, through permanent economic stagnation, which may compensate for problems such as high unemployment in Barratt sales.

Value

City experts are compatible in the city, and they expect construction profits to rise over the next two years

A 49 % increase is raised on an annual basis in the annual profits of this fiscal year (until June 2026). The expected growth is still 31 % in the financial 2027 as well.

These expectations mean that Barratt shares offer strong value in my opinion. The percentage of its price (P/E), which is 12.6 times for this year, decreases to 9.6 times for the next year.

Meanwhile, the P/E-To-Growth (PEG) is 0.3 stable during this period. Any sub -reading 1 indicates that the share is less than its value.

Finally, the broker consensus also suggests a strong profit distributions during this period. So the company’s future profit distribution revenues are health (rapidly increasing) 4.5 % and 5.4 % for Malians 2026 and 2027, respectively.

Nearly 40 % price gains

As with many UK’s shares, sharp economic conditions remain a problem for the company. But in a row, I am sure that the final result of bars still can improve steadily, making his share higher than today’s levels.

The 17th analysts in the city who reside the FTSE share all believe that the construction will refresh. The target consensus price sits at 516.6 pixels for the next 12 months. This indicates a 38.5 % increase in price.

Looking at the strong long -term expectations for homes, Barratt is a class that has been planned to carry for years. Its integration with Redrow last year gives it a great range to exploit this opportunity – the UK government targets 300,000 new homes every year from now until 2029.