Michael Silor’s strategy has just announced the purchase of a new Bitcoin, indicating that the price decline did not prevent the company from buying more.

The strategy made a new addition to the Bitcoin wardrobe

The head of the strategy, Michael Celor, announced in a new post on X, the company has completed the new Bitcoin acquisition of 3,018 BTC. The company bought these coins for 356.9 million dollars or an average price of 115,829 dollars per code.

According to the file at the US Securities and Stock Exchange Committee (SEC), the purchase occurred between August 18 and 24. This is the same window that BTC faced clouds. Thus, it seems that the company was not bilateral by making a declining price.

In fact, the company’s purchase of this week was much larger than last week’s purchase, which included 430 BTC ($ 51.4 million), or one of the previous week, which comes in 155 BTC.

After the latest acquisition, the total Bitcoin strategic possessions grew to 632,457 BTC. At the current exchange rate, this turns into approximately $ 71.1 billion, which is approximately 53 % higher than the company’s cost of $ 46.5 billion.

The balance of the profit loss in Bitcoin’s possessions is not the only thing that the company does well. Silor also participated in the X Publishing, the strategy also showed impressive performance.

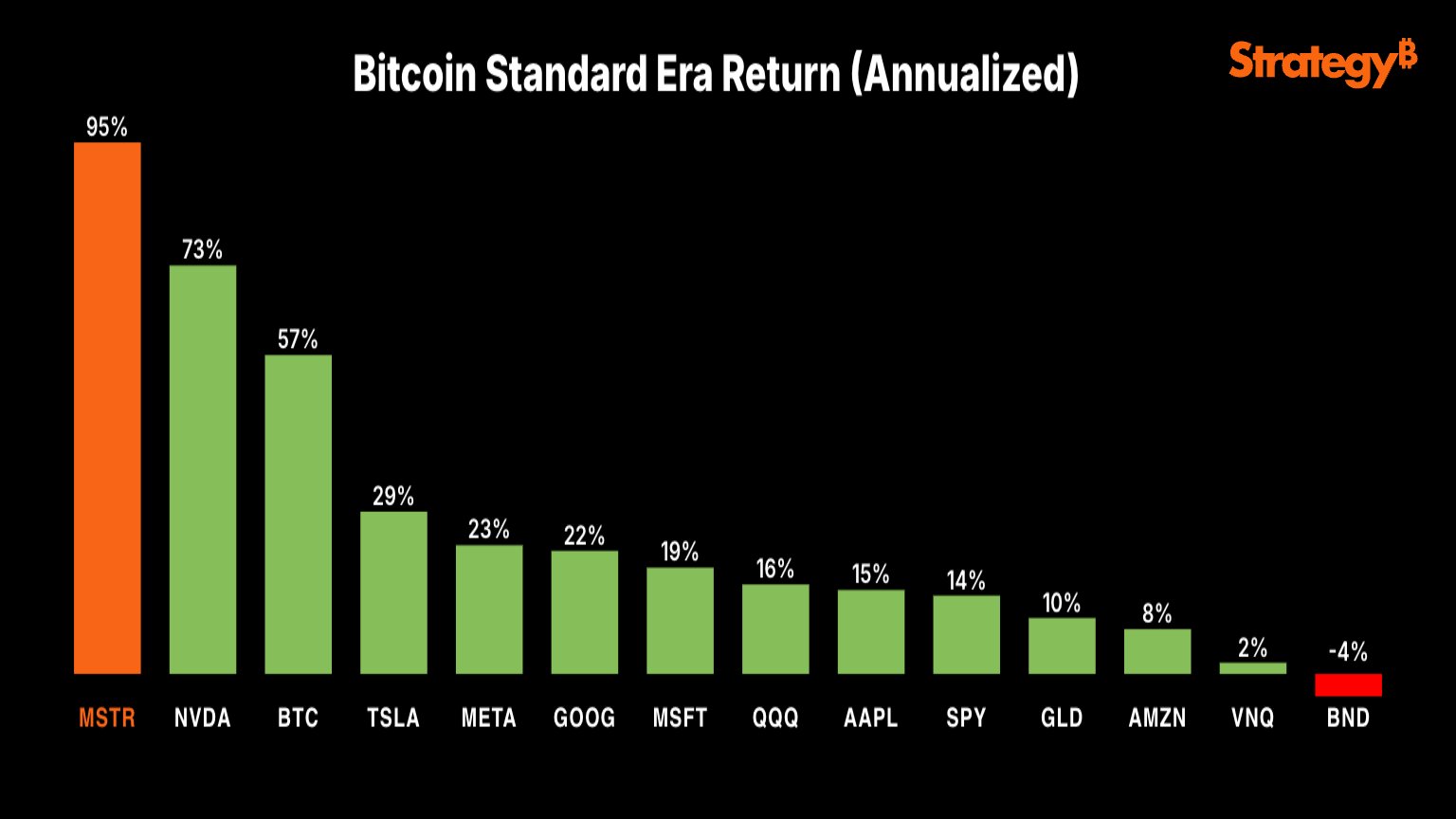

The performance of MSTR against other asset classes in terms of annualized returns | Source: @saylor on X

“Five years ago, $ MSTR has adopted the Bitcoin standard. Since then, we outperformed each group of origins and all wonderful shares 7,” the head of the strategy explains. Silor’s success began in the direction of other companies that also adopts the BTC Treasury strategy.

An example of this is Metaplanet Japan. Under the leadership of President Simon Jairovic, the company was constantly buying BTC like the strategy. On Sunday, Girovic revealed a new purchase of 103 BTC ($ 11.7 million), which increased the company’s reserves to 18,991 BTC (obtained with a total amount of $ 1.95 billion).

The treasury wave has now expanded to Altcoins, with Sharplink a prominent example. Ethereum Holdings currently sits on 740,760 ETH. Now, the news came out that Galaxy Digital, Jump Crypto and Multicoin Capital are planning a billion dollars of Solana accumulation for a Sol Treasury.

In some other news, the Cryptoquant Bull Score Index is currently informing the market as entering a declining phase, as shown in the X Publishing by Julio Moreno, head of research Cryptoquant. The Bull Score Index combines different standards on the chain to determine part of the Bitcoin cycle today.

The trend in the BTC Bull Score Index over the past year | Source: @jjcmoreno on X

As shown in the above chart, the Bitcoin Index recently decreased. Moreno notes: “The bull degree index is now forty years old and turns into the” landing “stage, Moreno notes.

BTC price

The Bitcoin’s dominant model continued during the past day, with the price decreased to the level of $ 110,900.

Looks like the price of the coin has been on the way down recently | Source: BTCUSDT on TradingView

Distinctive image from Dall -e, Cryptoquant.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.