Photo source: Getty Images

the FTSE 250 The medium stock index increased by 5 % in 2025. This is not bad, but it is less than the performance of other major global indexes. the FTSE 100 For example, 12 % rises during this period.

This performance reflects the weakness of a bleak look at the British economy, along with increasing pessimism about interest rate discounts with high inflation. Nearly 40 % -45 % of FTSE 250 profits come from Britain, much higher than FTSB with an international flavor.

Some of the indicator's upper quality components have already decreased sharply since January 1, which I think is a possible chance to decline. Below are two shares, I think they demand serious consideration today.

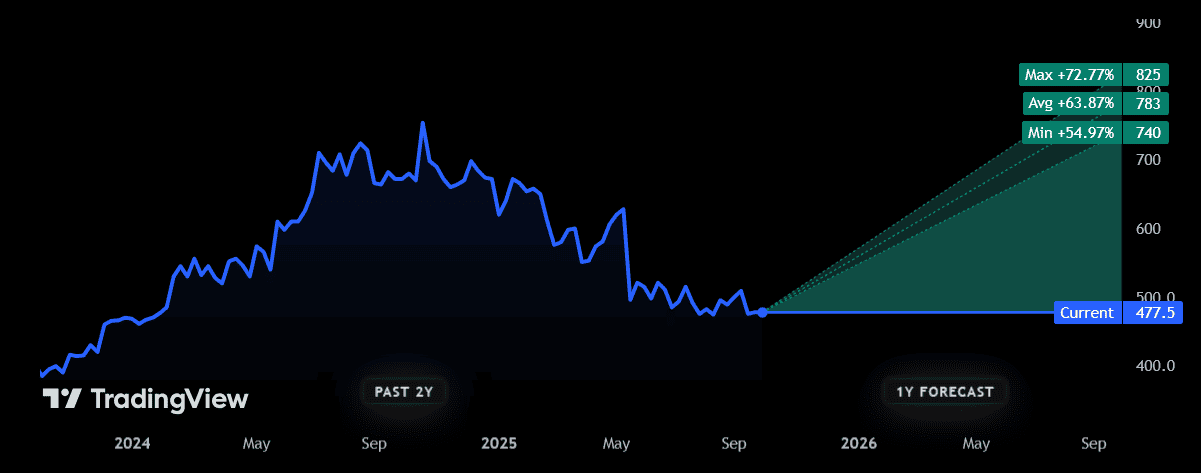

Bloomsbury Pubishing

Bloomsbury PubishingThe shares (LSE: BMY) has covered 29 % a year so far. While it is Harry Potter The privilege is still common as it was always, the weakness in other parts of the works has a sharp decrease in the book product.

More specifically, sales of poor sales in the academic publishing department has disposed of other company operations. Organic sales here announced 10 % in the last fiscal year, as it announced in May, in part due to budget pressure in the United Kingdom and the United States. The company has failed to recover the land since then.

Although these problems may continue, I think there is a lot that you like about Bloomsbury, which makes it worth a closer look. The long -term expectations for the strong Remians Publishing Unit helped get Gamechanging for the Rowan & Littlefield.

But what really attracts me is the quality of the consumer department, and more specifically its lineage in the markets of fiction and science fiction. Harry Potter It is not the only series of stars in its wallet – Sarah C. diamond A court of thorns and roses Another one of its best sales series, with 75 million sales and more contracted books to get off the pipeline.

The city analysts unite in his opinion that the shares of Bloomsbury will recover over the next 12 months. The consensus view of a 64 % increase in current levels, to 783 pixels per share.

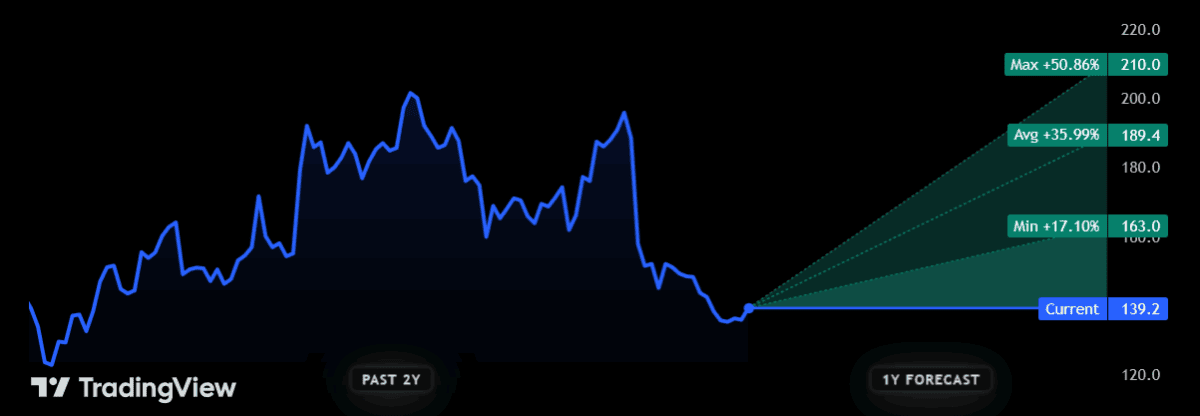

Ibstock

IbstockThe price of (LSE: IBST) has decreased by 21 % since January 1. It has retracted the fears that the last housing market recovery can be attached to the rise of the British economy and the high inflation.

For long -term investors, I think the issue of investing in the brick manufacturer is still strong. For this reason, I hold the company in Asa and ISA shares.

Despite the high competition, the increasing population requirements can be able to sales of products over the next decade. The government plans to build 3 million new homes until 2029 alone. Wisely, Epsk has invested greatly in the ability to meet the future demand.

But this is not all that attracts me, as I think the company can also expect to expect the reform, maintenance and improvement sector (RMI). UK housing stock is one of the oldest stocks in the world, so there must be a steady demand here for years to come.

As with Bloomsbury, the city's brokers are united in their belief that IBSTOCK shares will rise next year. The average price of the target arrow is 189.4p, and it represents a 36 % premium of today's levels.