Image source: Getty Images

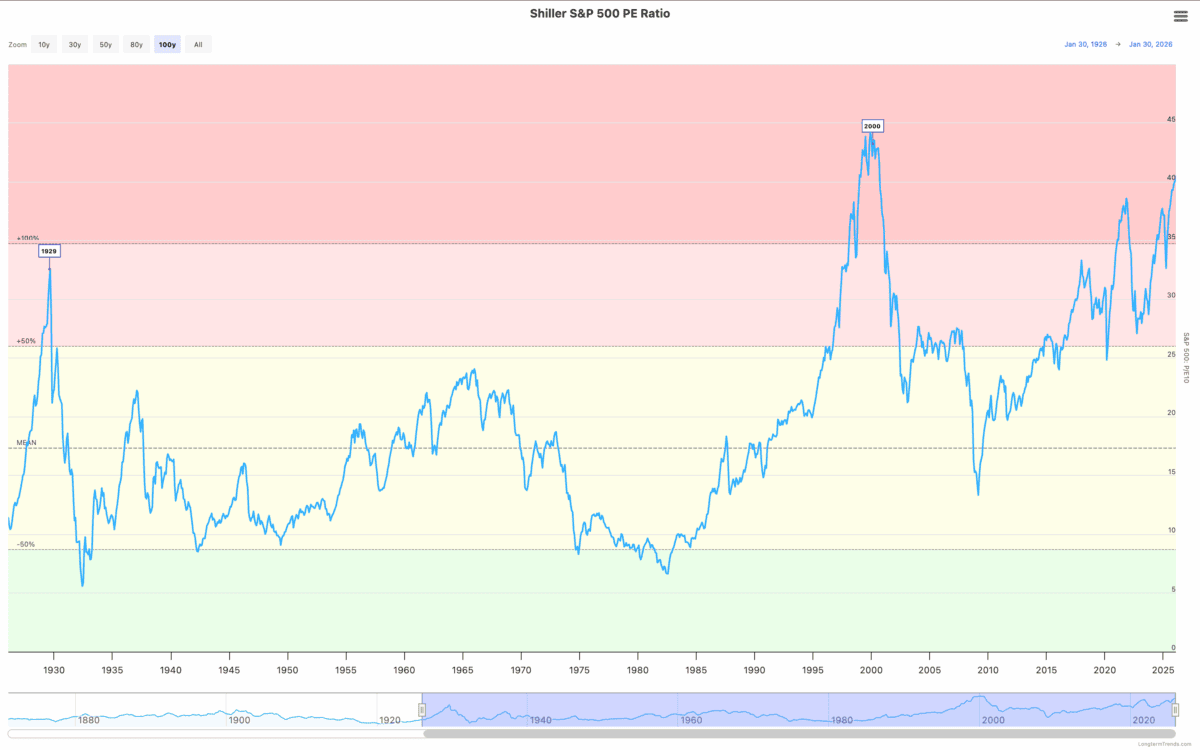

Adapt to cyclical fluctuations, which is the only time… Standard & Poor’s 500 They were more expensive than they are now in 2000. Right before the dot-com crash, tech stocks saw a decline.

Investors cannot ignore this, but the problem is what they should do about it. The solution is not necessarily to start selling shares, or even to stop buying.

Stock market crash

The similarities between the stock market in 2000 and today are almost impossible to ignore. The rise of artificial intelligence is very similar to the rise of the Internet.

The losses resulting from the dot-com crash were huge. Some stocks fell more than 90% and investors who bought them at their peak are still waiting for them to recover.

Beyond technology, there were stocks that not only held their value but actually rose as investors searched for safety. These stocks were in sectors such as consumer defenses and utilities.

Thus, one strategy for investors looking for US stocks in the current market is to look beyond AI for potential stability. But I think this is a risky approach and needs to be treated with caution.

Go defensive

One stock that did well in the 2000 crash was… Procter & Gamble (NYSE: PG). There are obvious reasons behind this – it has a strong position in a market where demand is constant.

The stock could hold up well if the market sells off again. But it has underperformed the S&P 500 since 2000 and investors need to decide if this is a real long-term opportunity.

Revenue growth over the past decade has been less than 2% annually. The stock is trading at a price-to-earnings (P/E) ratio of 22, which isn’t exactly cheap.

This is not a criticism, the growth opportunities have not been there in recent years. But investors need to think of the stock as a long-term investment and not just short-term speculation.

Stay the course

When thinking about the crash of 2000, it’s easy to forget that the best move for many investors was to stay put. Amazon (NASDAQ:AMZN) is a great example of this.

The company’s stock price fell by more than 95% when the dot-com bubble burst. But even investors who bought at the peak have made gains of more than 14,000% on their investments just by holding on to it since then.

There is a good reason for this. Amazon has taken a disciplined approach to creating value for shareholders. Its online platform has created a dominant position by focusing on the long term.

By focusing strongly on customers, it has created scale that makes it nearly impossible for other companies to compete with. The rest followed from there over time.

what i do

I own shares in Amazon and the company is in the midst of spending on AI. There is a real risk that this may not come to fruition if demand does not materialize as expected.

In this case, the stock price may fall. But I’m a buyer, not a seller, at today’s levels – even with the S&P 500 at historically high valuation levels.

In my opinion, the lesson of history is very clear. Investors who can identify companies with long-term competitive advantages need not worry about a short-term stock market crash.