Photo source: Getty Images

For more than a decade, Legal and public The shares (LSE: LGEN) has proven a strong arrow to buy for investors looking for a negative income.

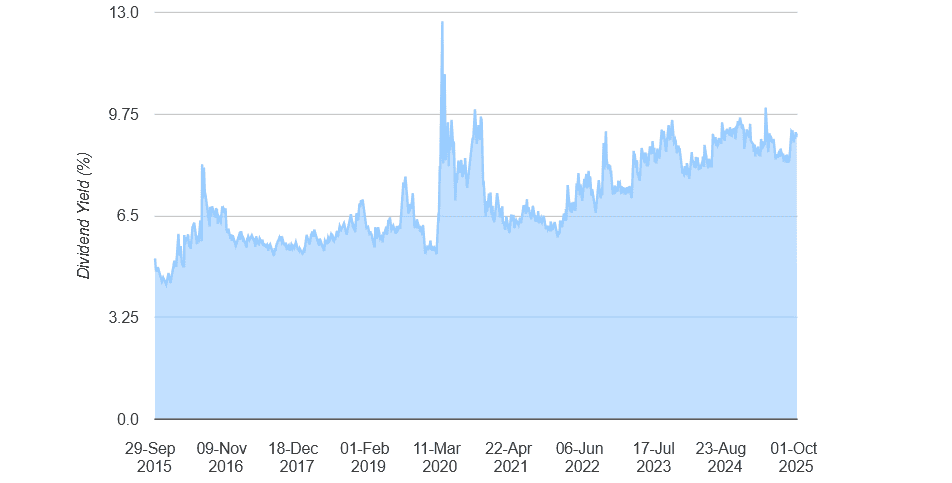

Since 2015, profit distributions have grown with an average annual growth of 6.2 %. As the drawing below shows, the profit revenues in the financial services giant were enormous during this period. To give them context, the average long -term return is 3 % -4 %.

The impressive Legal & General profit record is supported by rich cash flows and strong profit distribution culture. But amid an uncertain economic scene, can the company maintain a generous payment policy?

Slower growth, big yield

Although the mediator's expectations are not placed in the stone, it is of course good to know what the city predicts. Here, things seem promising:

| year | Distribution of profits for the share | Profit growth | Profit |

|---|---|---|---|

| 2025 | 21.79p | 2 % | 9.2 % |

| 2026 | 22.23p | 2 % | 9.4 % |

| 2027 | 22.71p | 2.2 % | 9.6 % |

The first thing you will see is that profit distributions continue to grow in the medium term, albeit at a slower pace than previous years.

This is in line with the company's current capital distribution policy. Under the plans presented in 2024, the growth of future profit distributions will be linked to a rate of 2 % fewer, but with the re -purchase of shares in the completion of cash revenues.

As a result, profits growth may follow in the inflation rate, which means that the real value of the payments may decrease. However, with no returns exceeding 9 % and growing during this period, the stock may still be convincing for profit distribution investors.

Cash

As I say, the profits are never guaranteed. So let's see how strong these expectations are.

In the first procedure – the profit cover – these estimates appear somewhat cortical. This scale measures the extent of the expected rewards through the expected profits, which are advisable to read twice or more.

With legal and public shares, the expected stock profits for this year are higher than the expected profits per share (20.78p). Things improve after that, but the profit distributions are modest at 1.1 and 1.2 of 2026 and 2027, respectively.

It is clear that this is not great. But this is definitely not a reason for panic, in my opinion. The sub-coverage of information has always been a feature of private FTSE 100 shares, however-thanks to its rocky solid public budget-this did not prevent the delivery of large and growing profits over the past ten years.

Legal & General's Cash Rich also remains today. So I am optimistic because at least can meet those profits that the city's brokers expect. The company's II's capital rate for the company was 217 % as of June.

Is legal and public purchase?

LEGAL & General, in my opinion, is still one of the most negative income shares that must be observed today. There is a good reason because it is currently the largest individual song in my own portfolio.

However, investors need to consider the risk of owning the share. Although it still pays great profits, the price of the Legal & General shares continues to struggle. It has increased by only 2 % per year so far, which means that investors could have obtained better total returns anywhere.

This may remain like this if the economic conditions are difficult. But in the long run, I am sure that it will make great capital gains along with additional profit distributions, with the support of strong growth in the retirement, insurance and asset management markets.