Photo source: Workshop PLC

Over the past two years, growth shares have occupied a rear seat. High inflation, high interest rates and nervous investors turned towards valuable and defensive sectors. But with inflation now facilitating and most likely raising prices near its peak, are growth shares in the United Kingdom finally a return?

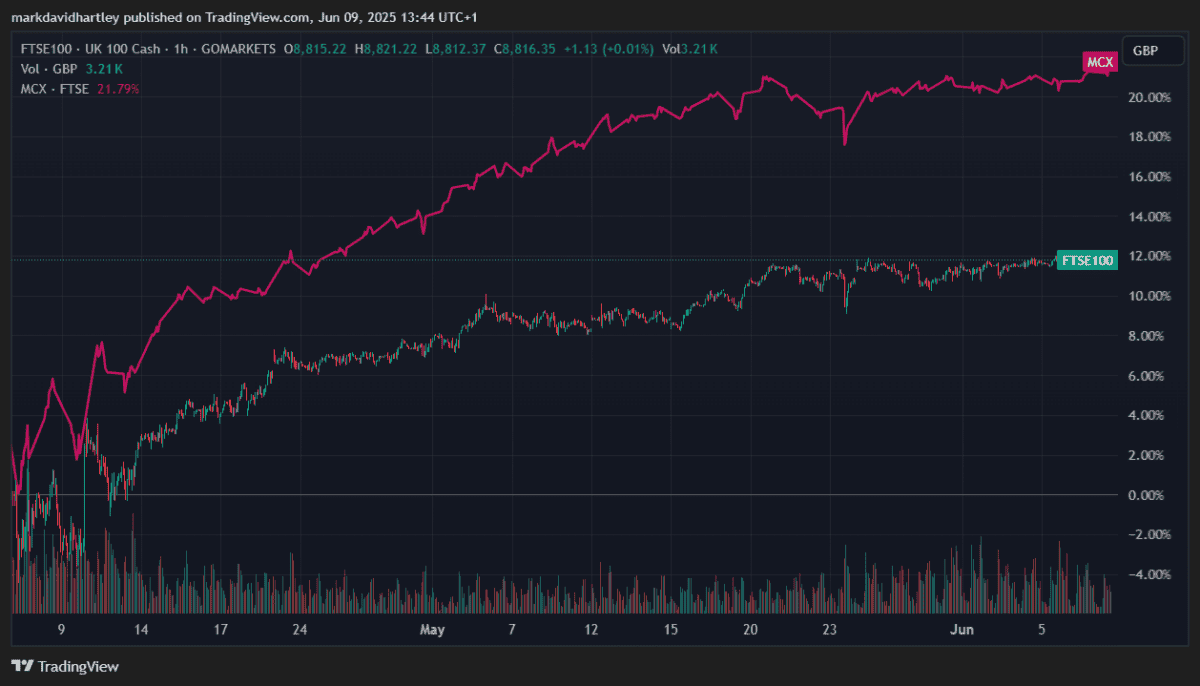

The first days are still, but the signs are encouraging. the FTSE 250The home of many of the best growth names in Britain, began to excel over FTSE 100 In recent months. This is usually a sign that investors have begun to prefer the most dangerous and fastest growing business again.

Why are growth shares fight?

Growth shares are often with strong future profits, but much of this value is related to expectations. When interest rates rise, these future profits are more deducted, making growth shares appear less attractive compared to fixed alternatives to the four. This is a major reason for technical and consumer estimated companies during 2022 and 2023.

But now inflation in the UK has decreased to less than 3 %, and the Bank of England is expected to reduce prices later this year. If borrowing becomes cheaper, growth companies may find that it is easier to collect capital, invest and apply for these long -term expectations.

Signs of recovery

The latest results from many high -growth UK companies were strong. For example, FTSE 250 is popular with popularity Gaming workshop (LSE: GAW) reported record revenues and profits in its latest update, as the international expansion continues to pay the momentum. Her shares have increased more than 20 % so far.

With complete control of intellectual property, the development and licensing of the probability of the likelihood Warhammer Franching, his future appears promising.

Revenue has grown steadily, supported by the base of loyal fans, new products versions and expanding the range of channels on the Internet. The recent results showed a two -digit profit, with the addition of the income of kings from the media deals, adding a profitable revenue flow. Despite its specialized market, international demand is still rising.

However, there are risks. The stock shares are traded to the profits (P/E) of 30, leaving a big room for growth. If the results fail to influence, this may lead to short -term losses. Growth is also associated with consumer spending, which can fluctuate in decline.

However, with a public budget rich in criticism and a global call, the arrow deserves to consider growing in the long run.

Other shares of FTSE 250, which has been seen recently, is a recent street retail store Curry. The stock increased by 30 % this year after a strong performance led by the integrated laptop sales of artificial intelligence (AI). Last month, the company raised its profits for the third time this year after its share price reached the highest level in four years. With only 7.5 P/E, it seems that it still has a lot of growth.

The next opportunity

The tide may turn into growth shares in the UK. Low inflation and potential transformation in monetary policy created more conditions for long -term capital estimate. But selective remains the key.

While FTSE 100 tends to prefer income and stability, there are still a lot of growing opportunities in FTSE 250 and goal Markets. For investors ready to do their duty – a little bit of fluctuations – time can be the time to re -offer some exposure to growth in a balanced portfolio.