When you buy something through a single link on our site, we can get the affiliate commission.

The candle is surrounded One of the easiest and potentially the most underlined chart samples in the trade.

In this tutorial, I show you how to identify the pattern, what does it tell us as a trader and I will give you some business strategies that use this sample.

Many people make this style more complicated, but it’s very easy.

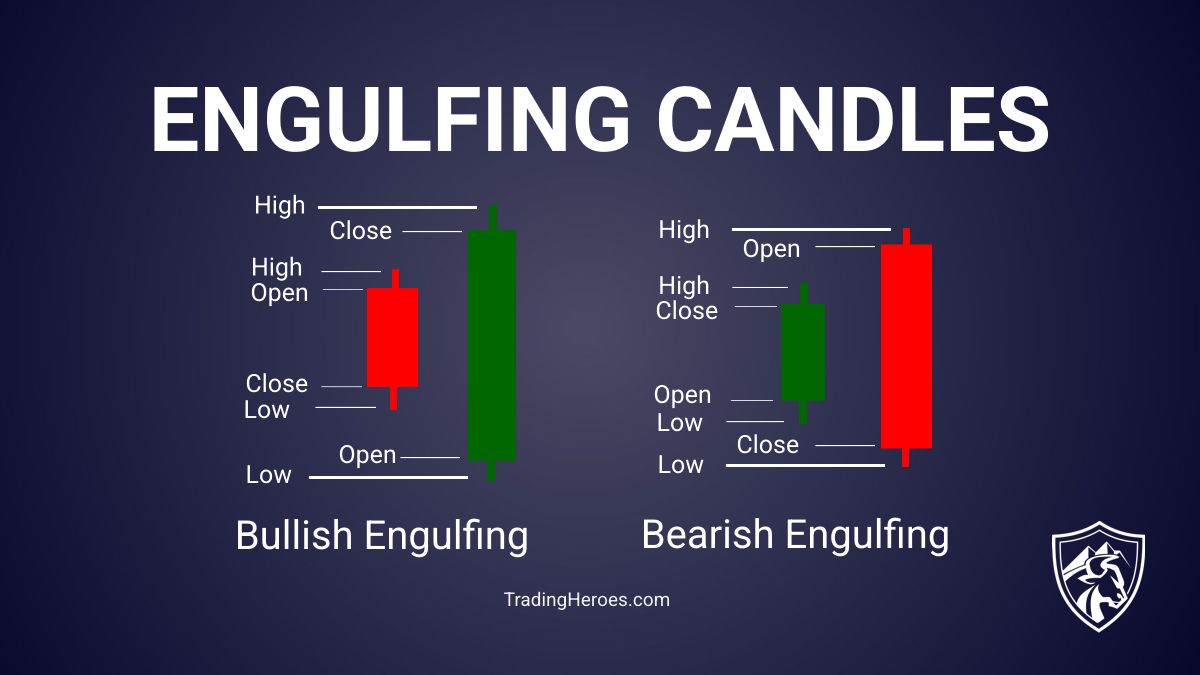

Are mainly existing 2 types of linking candles.

This is how to identify them.

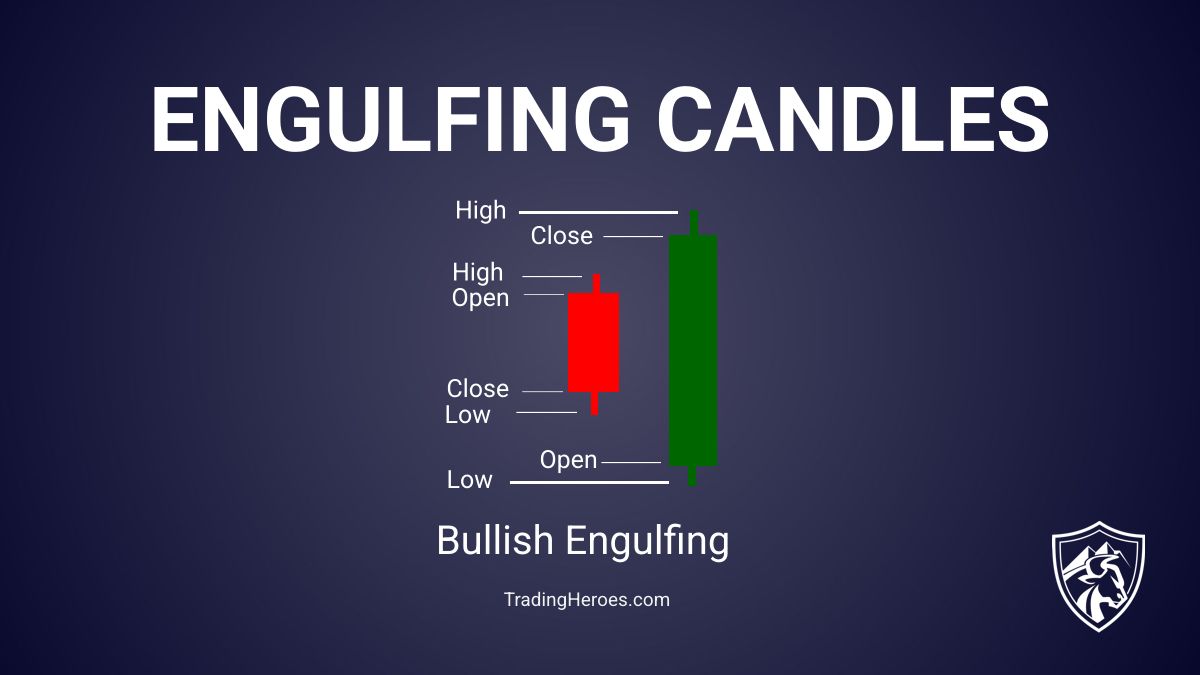

Fast candle

A The candle sample From some extent to a higher level, it is likely to turn upside down.

Here’s what to see:

- 2-Kandand forming

- The first candle is smaller than the second candle and is less than open

- The second candle has the largest body of a candle that is seen in a while and is more open than open

- The second candle height exceeds the height of the first candle

- The lower part of the second candle is minimal of the first candle

- The second candle closes closer to the height of its limit

- This sample is to print on a support or resistance level

Examples

Here is an example of a rapidly connected pattern on one Butt coin The chart shows the blue arrows rotating candle.

Consider how the dramatic turning point was on the chart.

Obviously it doesn’t happen all the time, but it is often the case that you should pay attention.

There is another example here on the USDCHF Forex duo.

After printing at the previous support level, he staged a rigorous rally.

So these are just a couple of examples when one Fast candle Can point to a market upward.

Now let’s take a look at the opponent of this style.

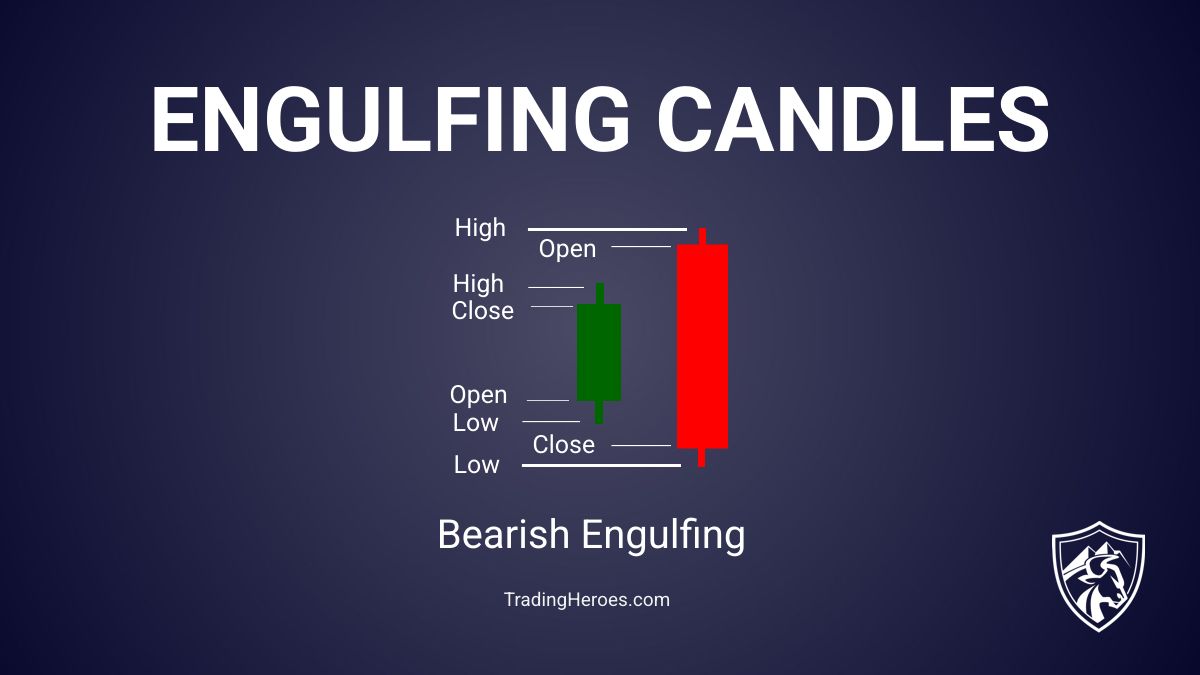

The beaten candle

A Barrch linking candle sample From some extent to a higher level, it is likely to turn upside down.

Here’s what to see:

- 2-Kandand forming

- The first candle is smaller than the second candle and is closer to the open

- The second candle is the largest candle that has been seen in a while and is less than open

- The second candle height exceeds the height of the first candle

- The lower part of the second candle is minimal of the first candle

- The second candle closes near the bottom of its range

- This sample is to print on a support or resistance level

Examples

This example shows an example on the Audins D Chart how fast a faster price can move In the wrap of fish Candle sample.

Consider how it prints on the back level of resistance.

Now here is an example on the NZDCAD chart.

Once again, a sharp move took place after printing a candle printing candle.

Take a chart and start looking for this style.

You will see that this is much more than you expect.

But don’t stop there.

Must test this style Ago The risk of real money.

My favorite candle resources

There are resources here to surround the candle trade strategies that have proved to be very useful to me.

You use them to create, test and trade. Can To surround the candle trade strategies.

How to prove linking candles actually work

At this point, you are probably thinking: Does it actually work?

This is a very natural question and the only thing that matters is very clearly.

So here is the truth about trading candles …

Just like any other trading procedure, the success of the chart pattern will be determined by the Lord The specified trading plan.

There are many ways to enter and get out of trade with this style, so you need to explain these parameters of real trading strategy.

I will provide specific trade strategies in the next section.

But this is the place where most traders slip …

Remember, there are only 2 types of trade strategies, arbitrary and fully automated.

Most It is arbitrary to surround the candle strategies.

Therefore, the results between traders may be very different.

So it is important that you find yourself to know how good you are to identify the setup in your trading strategy plan.

Practice can also improve your abilities, so don’t be afraid of being in the mood until you feel that you increase your abilities.

Now it is possible to automatically make the candle strategy. If so, then the results are usually produced among the traders.

Even then, you still have an automatic strategy and Testing this on every market/time frame you trade.

Always confirm, never take the word of another person for it.

Remember, a profitable trading strategy usually begins the same way Lot Non -profit ideas.

So start experimenting and don’t be afraid to check your thoughts.

You can only discover the amazing thing.

Trade strategies that use candles

Here are some trading strategies that you can review and start testing for yourself.

I have also included the results of my backstating so that you can compare the notes and improve these strategies.

The final views

This very simple candle pattern can be the basis of your next grill trading strategy.

It is easy to identify and can be programmed in most commercial platforms.

But it is up to you to test it and find out if it will work or not.

Remember, the world’s most profitable strategy is the one that fits you the best.

Now go to work.