Glassnode revealed the analysis companies on the series in a report that the bitcoin owner has slowed the distribution after months of sale.

Changing the net Bitcoin site in the long run is now neutral

In its recent weekly report, Glassnode spoke about how to change the behavior of Bitcoin's recently long -term bitcoin. Long -term LTHS refers to BTC investors who have been holding their currencies for more than 155 days.

Statistically, the longer they maintain their metal currencies on Blockchain, the less likely to sell them at any time. As such, LTHS with a relatively long -time retained time is the network diamond.

This can make the behavior of this regiment worth monitoring, as transformations can have consequences for the cryptocurrency as a whole, taking into account its position.

There are many ways to track LTH behavior, with one way with a scale changing the clear position. This indicator, as its name suggests the monthly monthly change in the Bitcoin supplies that LTHS keeps as a whole.

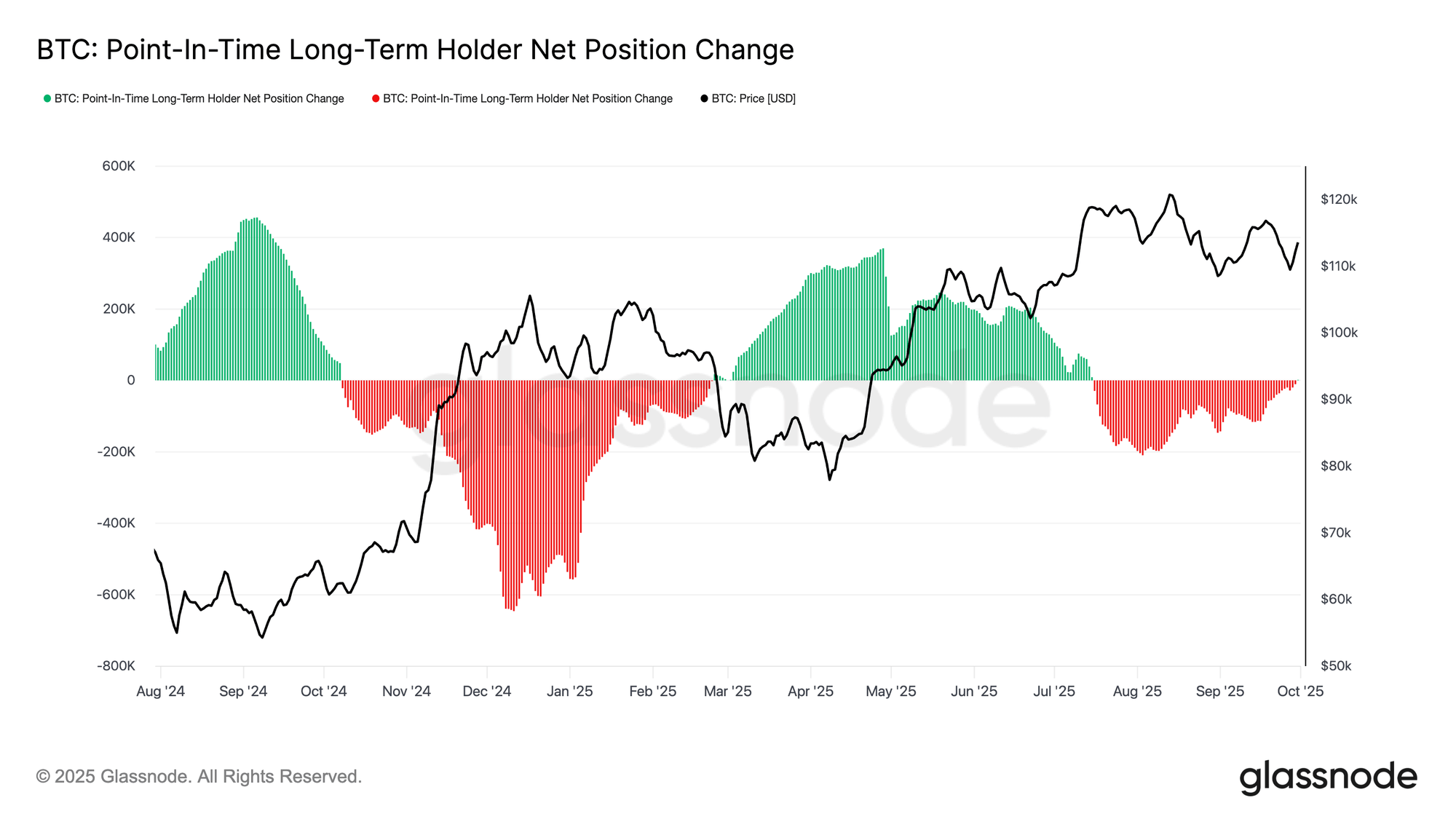

Below is the Glassnode chart, which the trend appears in its value during the past year.

Looks like the value of the metric has been negative in recent months | Source: Glassnode's The Week Onchain - Week 39, 2025

From the graph, it is clear that changing the Bitcoin LTh Net site was positive during the first half of 2025, but a shift occurred in July where the index turned into negativity. This means that the show began to get out of the regiment.

Something to take into account is that while for sale from the group it is possible to register immediately on the graph, the same thing is not true for purchase. When the LTH supply rises, this does not mean that the accumulation occurs at the present time, but some purchase occurred 155 days ago, and these coins have now been kept long enough to become part of the group.

The LTH distribution lasted until August and September, but with the beginning of October, the pure position returned to a neutral value, indicating that the currencies that are being sold by the group are now balanced with maturity code after the 155 -day pieces. In other words, the net profit was calmed down.

The report also explains:

This cooling supply pressure indicates that the last stage of achieving a long -term holder may be a mitigation, which may leave the traded investment funds and new flows as more crucial engines for the market direction.

ETFS also witnessed a recent shift, as another graph cited by Glassnode.

How the netflow related to the US BTC spot ETFs has changed over the last twelve months | Source: Glassnode's The Week Onchain - Week 39, 2025

As shown in the graph, the investment funds circulating in the United States turned Bitcoin into external flows in late September, but Netflow again turned to the green color of these investment compounds. Analysis Company notes:

If this renewed demand is aligned with a lower LTH, the traded investment funds can provide a stability force, providing a more constructive basis for price flexibility and supporting the conditions necessary for sustainable progress.

BTC price

At the time of this report, Bitcoin floats about $ 119,700, an increase of about 8 % over the past seven days.

The trend in the price of the coin over the last five days | Source: BTCUSDT on TradingView

Distinctive image from Dall-I, Glassnode.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.