Standard Charterd has become the first large bank to launch immediate trading of Bitcoin and Ethereum, a major landmark for the accreditation of encrypted currency.

Standard Carted Bitcoin, ETHEREUM Trading for Institutions

According to a press release, Standard Charged implemented a handable spot circulation of the two largest names in the cryptocurrency sector, Bitcoin and Ethereum. “In line with its commitment to providing safe, reliable, effective and effective digital asset solutions, and after launching the successful digital assets custody service, Standard Charterd today launched an integrated digital assets service for institutional customers,” the press statement says.

Standard Charterd is a systematic global bank (G-SIB) its headquarters in the United Kingdom (UK). The bank has branches all over the world, but the launch of the digital asset trade specifically comes through the UK arm.

This is the first example of G-SIB services that provide immediately handable trading services related to encrypted currencies. G-Sibs are strong institutions that are so interested in the global economy that its collapse can lead to a wider financial crisis. As such, the organizers closely see these banks and put them through a more strict audit of regular institutions. Thus, in order for the G-SIB to enter the Bitcoin spot trading space it can indicate the progress made by digital assets in its acceptance by traditional financing.

“Digital assets are an essential element of development in financial services,” said Bill Winters, the group’s CEO of Standard Charterd. “It is an integral part of enabling new paths for innovation, larger inclusion and growth throughout the industry.”

Although this is the first time that the bank has provided Bitcoin and Ethereum trading services for institutions, it is not its first project in the wider digital assets. Standard Charterd has investments in the custody markets in Zodia and Zodia, where companies provide a set of services related to the encrypted currency.

“We apply our global experience, infrastructure and risk management that our customers trust in the area of digital assets,” said Tony Hall, global trading head and XVA, markets in Standard Chartard.

The latest G-SIB service is connected to the bank’s current infrastructure, allowing institutional customers to participate in Bitcoin and ETHEREUM trading activities through foreign exchange facades (FX) that they already use. The press statement added: “Customers can settle for their choice of lies, including the solutions of safe nursery from the digital assets from Standard Charterd.”

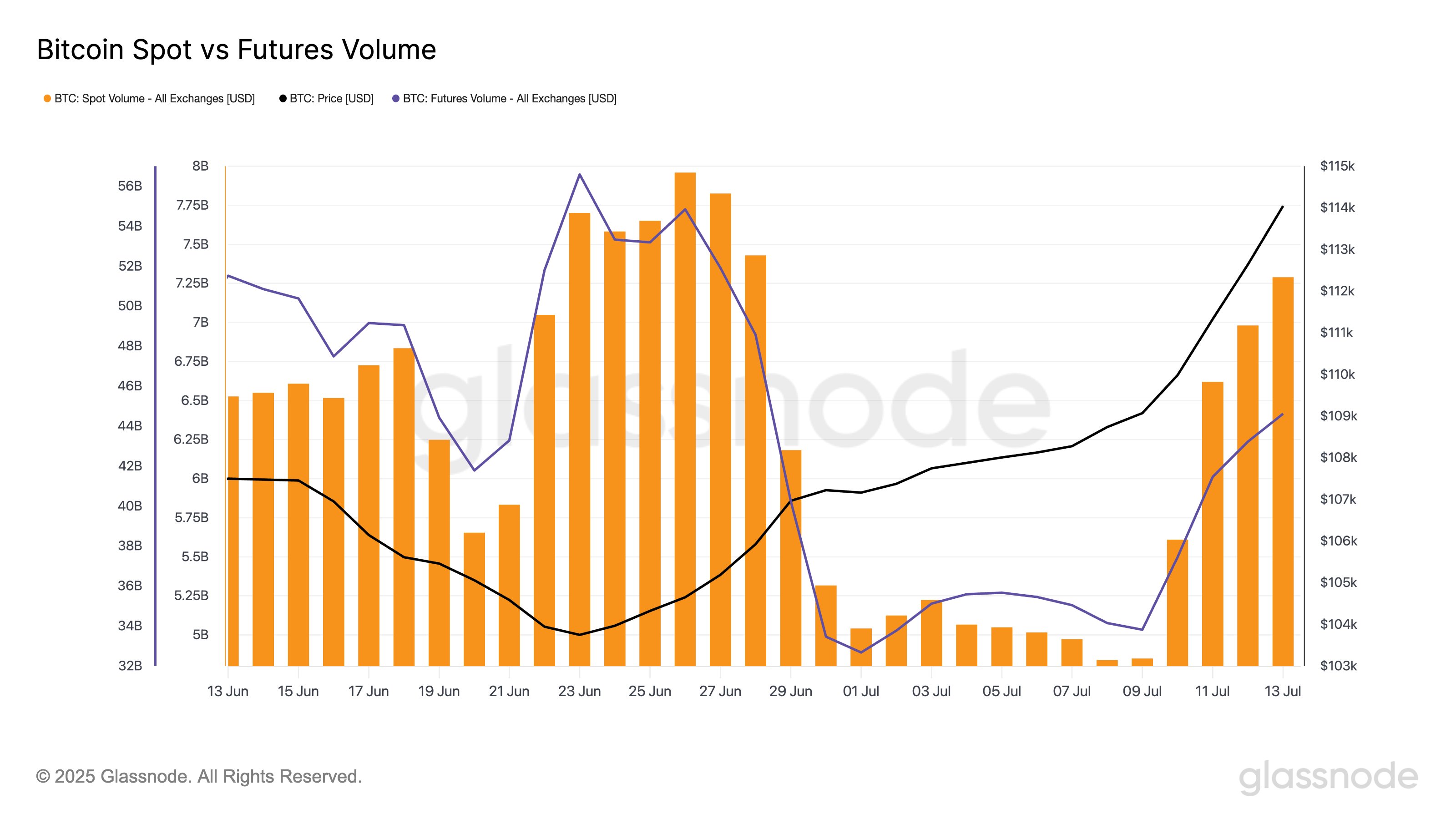

In some other news, the Bitcoin spot trading witnessed a revival alongside the latest price increase, as Glassnode indicated his company in the X.

The trend in the spot and futures trading volumes related to BTC | Source: Glassnode on X

Since July 9, the stain size increased by 50.3 % and futures volume by 31.9 %. While this is a big leap, the most widely range of commercial activity remains relatively silent. Compared to the general average, the spaces of space and futures are both more than 20 %.

BTC price

At the time of this report, Bitcoin is trading about $ 117,000, an increase of more than 7.5 % last week.

The price of the coin has seen a drop over the past day | Source: BTCUSDT on TradingView

Distinctive image from Dall-I, Glassnode.com, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.