The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

With the escalation of political tensions between US President Donald Trump and Elon Musk yesterday, Bitcoin (BTC) witnessed a sharp shift in the feeling, as the rate of financing to stir from positive to negativity was within hours.

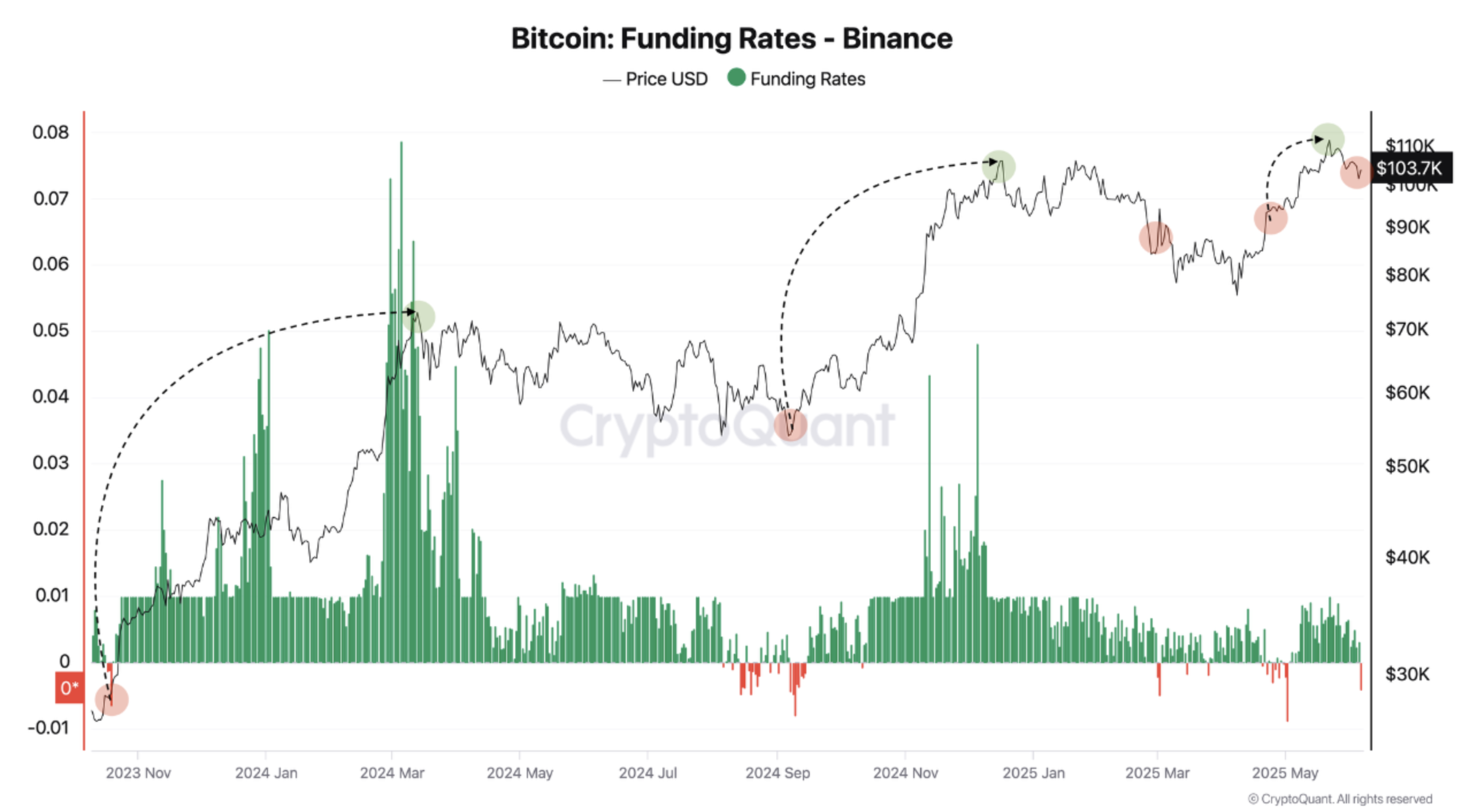

Bitcoin financing rates turn negatively on Binance

According to A Cryptoquant QuickTake Post by Darkfost shareholder, BTC financing rates on Binance have become negative again, even as the upper encrypted currency continues to trade above $ 100,000 at the time of writing this report.

Related reading

End the analyst Sudden reflection In financing -from +0.003 to -0.004 -to the general dispute between Trump and Musk on social media. This rapid shift reflects the increasing fear among market participants amid increased uncertainty.

In the wake of the transformation of feelings, BTC fell from the average range to $ 100,000 to less than 100,984 dollars, according to Coingecko. During the past two weeks, the original has decreased by 4.1 %.

However, the current decrease may provide a major opportunity for investors. If Bitcoin is strongly committed, this may lead to a strong return in purchasing pressure, which leads to a short pressure that may push the price of BTC up.

Darkfost highlighted that there were three cases during the current market tournament when BTC witnessed this deep negative financing. It is worth noting that each of these cases followed a strong upward step in the encrypted currency.

For example, on October 16, 2023, BTC fell to a negative financing area before the gathering from $ 28,000 to $ 73,000. A similar pattern was operated on September 9, 2024, when the original rose from $ 57,000 to $ 108,000.

The latest case was on May 2, 2025, when BTC jumped from $ 97,000 to the highest new level (ATH) of $ 111,000. If you repeat the date, the new ATH market may witness BTC in the coming weeks. Note Darkfost:

These extremist readings often constitute moments of the maximum pessimism, a kind of feelings that can precede a strong upscale reflection when negativity disappears in the short term.

Big investors increase BTC exposure

Meanwhile, the whales in Bitcoin – a portfolio bearing large amounts of BTC – continue to accumulate at a rapid pace. It is worth noting that the new whales have acquired BTC worth $ 63 billion, which reflects strong confidence in the prospects of assets close to assets.

Related reading

Support these upscale expectations, modern analysis by QCR Capital Indicate Big investors expect BTC to rise to $ 130,000 by the end of the third quarter of 2025. They exceeded 20 billion dollars, which enhances positive feelings.

However, some analysts urge caution, expected BTC to break down less than $ 100,000 before resuming its bullish momentum. At the time of the press, BTC is trading at 104,069 dollars, a decrease of 0.5 % in the past 24 hours.

A distinctive image of Unsplash, plans from Cryptoquant and TradingView.com