The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Bitcoin has decreased to $ 10,450 yesterday, erasing about one billion dollars of tied bets over the past 24 hours. Many merchants were quick to sell, but the fall was short -term.

Related reading

Bitcoin found her foot and climbed to $ 104400 by the time when this report was presented. According to the recent analysis by Crypto Klarch, this withdrawal and may be just stopping before running to its highest fresh levels.

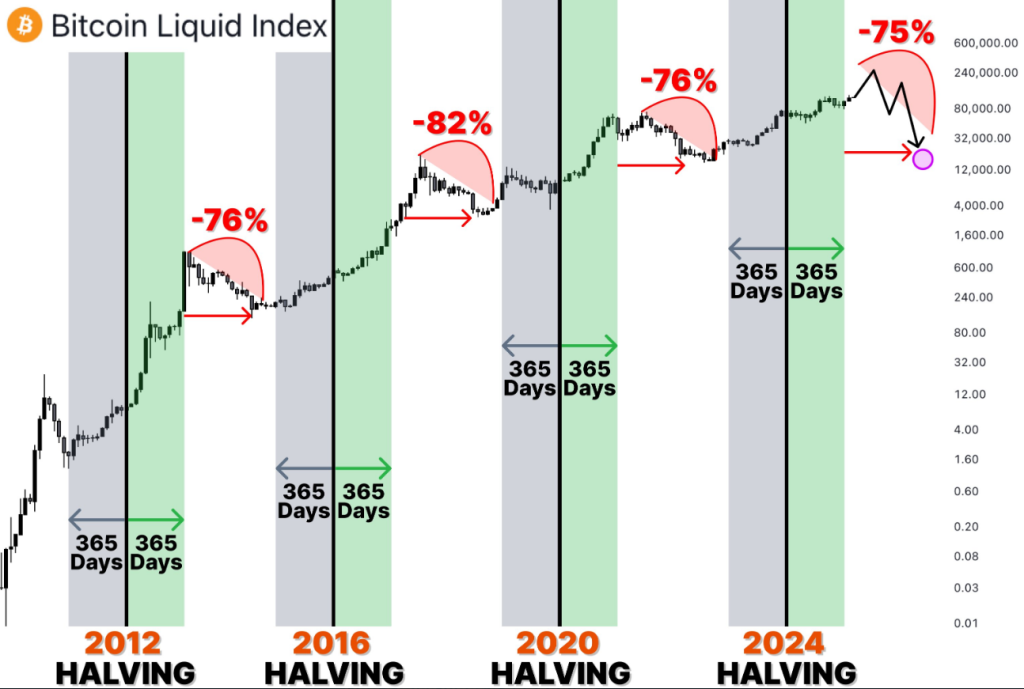

Repeated course patterns

Based on the examination by KLARCH, Bitcoin tends to follow a familiar path after half. After one year of half 2016, about 280 % rose. After 2020, about 550 % jumped in 367 days.

Currently, Bitcoin rose only about 70 % in 416 days since the last half. KLARCH indicates that in previous sessions, these speed numbers rose after a slow start. As he says, there is still room for further growth.

Bitcoin courses are identical …

– In 2016, $ BTC It grew by 280 %, 365 days after half

– In 2020, $ BTC It grew by 550 %, 367 days after half

Now, 416 days after half, $ BTC +70 % – future growth …History is repeated, here is the future near BTC 🧵👇 pic.twitter.com/wshx4egwbc

– klack (@0xklarck) June 5, 2025

These percentage ratios are important because they hint on what may come after that. If the history of Bitcoin is repeated, it may be the best of the brackets or lower. Information from Blockchain data also supports this.

For example, trading volume and chain addresses have reached new levels in recent weeks. This fits the pattern described by Klarch – after the initial height, there is often a greater gathering.

The next increase signs

Bitcoin set a record of $ 112100 on January 20, then rose to $ 111,980 on May 22. Instead of indicating an end, Klarch believes that these prominent landmarks are the beginning of a higher peak. He sees these moves as part of the accumulation of the session, not its climax. Based on his work in the scheme, each session contains multiple peaks before finally topped.

KLARCH did not make a delicate date for a new climax, but he suggested that Bitcoin has not yet reached its roof. It indicates that a series of its highest levels ever occurs when feelings are still positive. Once FOO traders feel, the price often accelerates quickly.

Related reading

Driving price and liquidity

The liquidity in the encryption market was a major point of discussion. KLARCH says fixed purchases of institutions and ETF Sot Bitcoin Us made Bitcoin a scarcity of exchanges.

Michael Silor and other players in the large money continues to buy, pushing the offer to decline. Based on the numbers of KLARCH, this Bitcoin trend can be raised to about $ 180,000 – an increase of about 75 % of the current levels.

VANECK, Director of Assets, shared a similar goal. This makes Klarch look like a single voice. If the large money continues to move and the retail selling interests remain high, the bitcoin price may remain in the rise. However, any stop in ETF flows or a sudden shift in global markets can change that story.

Distinctive image from imagen, tradingView graph