Bitcoin continues to struggle under downward pressure following last Friday's sharp market decline, with traders still reeling from one of the most volatile weeks in months. While Bitcoin struggles to stay above the $105K-$106K area, gold has risen to all-time highs, indicating growing uncertainty in global markets. This divergence between traditional safe havens and risky assets has left investors wondering what the macroeconomic signal really means — whether it is a sign of deeper economic fragility or a temporary turnover of capital.

Amid this cautious environment, an interesting move by a well-known whale caught the market's attention. The trader — famous for shorting both BTC and ETH during last week's collapse on Hyperliquid — is now going long, opening massive leveraged trades on the same assets he profited from shorting.

The whale's actions have raised speculation about a possible recovery in the short term. Some analysts suggest this may mark the beginning of market maker accumulation, especially as funding rates reset and liquidity returns to normal. However, with Bitcoin showing technical weakness and macro headwinds intensifying, traders remain divided: Is this whale betting on an early reversal, or is it simply preparing for another volatility-driven shakeout before the next major move?

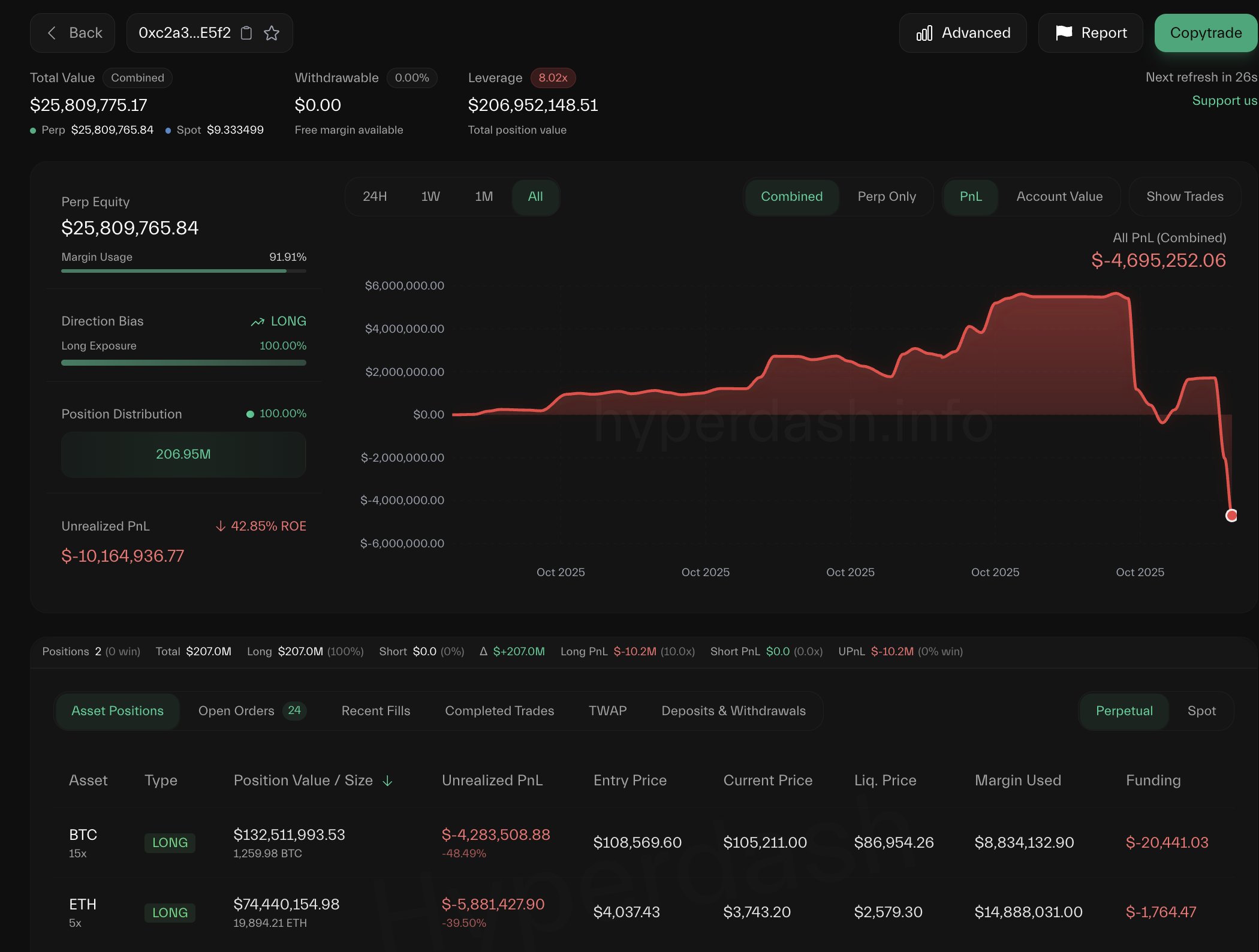

Pisces doubles down despite unrealized loss

According to Lookonchain insights, the famous Pisces (0xc2a3) is now facing a major reversal in fortune. After flipping his strategy and opening massive long positions on both Bitcoin and Ethereum, the trader saw his previous profit of $5.5 million wiped out completely, and now suffers a net loss of $4.69 million. Despite this, on-chain data shows that he continues to add to Bitcoin long positions, suggesting a high-conviction — or high-risk — bet on an imminent market recovery.

At present, whale positions stand at 1,260 BTC ($132.5 million) and 19,894 Ethereum ($74.4 million). These are some of the largest open positions on Hyperliquid, which are subject to intense scrutiny from traders and analysts alike. Some speculate that its strong accumulation indicates insider confidence or long-term strategic vision, while others warn that it may simply reflect excessive optimism amid deteriorating market structure.

Meanwhile, Bitcoin price continues to drift towards the lows, hovering just above $105,000, as short-term holder realized prices and key moving averages converge. Continued selling pressure across exchanges and persistent bearish sentiment indicate that the market has yet to find a solid footing.

However, the whale's behavior has sparked renewed debate about whether the smart money is being positioned early before the recovery or is misjudging a still-fragile market. If he is found guilty and Bitcoin stabilizes, this could represent a major accumulation phase before the next phase higher. But if not, losses could go deeper – reaffirming just how volatile and unpredictable the overall Bitcoin landscape is.

Bitcoin is facing a weekly collapse as trading volume rises

Bitcoin's weekly chart reveals a decisive shift in momentum, with the price closing near $105,800 after a sharp -8% decline during the week. The correction erased several weeks of gains, pushing Bitcoin dangerously close to its 50-week moving average (MA50), which is currently around $101,700 — a level that has historically served as strong support during mid-cycle consolidations.

What stands out most in this chart is the sharp increase in trading volume, the highest since late 2023, confirming that the recent sell-off was driven by significant market participation. The large red volume bar indicates widespread capitulation among short-term holders, which is consistent with on-chain data showing increasing realized losses and rising selling pressure across exchanges.

If Bitcoin can hold above the $103K-$106K range and defend the MA50, the structure may remain within a broader bullish continuation pattern. However, a confirmed weekly close below this support would likely trigger a deeper bounce towards $100,000 or even $97,000, where the 100-week EMA currently lies.

Featured image from ChatGPT, chart from TradingView.com

Editing process Bitcoinist focuses on providing well-researched, accurate, and unbiased content. We adhere to strict sourcing standards, and every page is carefully reviewed by our team of senior technology experts and experienced editors. This process ensures the integrity, relevance, and value of our content to our readers.