On-chain data shows that ERC-20 stablecoins are currently seeing the highest number of exchange withdrawal transactions since May 2021.

Investors withdraw their stablecoins from exchanges

In a new post on X, CryptoQuant community analyst Maartunn shared about the latest trend in exchange withdrawal transactions for Ethereum-based stablecoins. This indicator, as its name suggests, measures the total number of transfers related to an asset or group of assets flowing from wallets linked to central exchanges to self-custodial addresses.

Generally, investors take their coins into self-custody when they plan to hold them long-term, or at least, are not looking to replace them immediately. As such, the high value of exchange withdrawal transactions could be a signal that investors are not looking to sell the cryptocurrency at the moment.

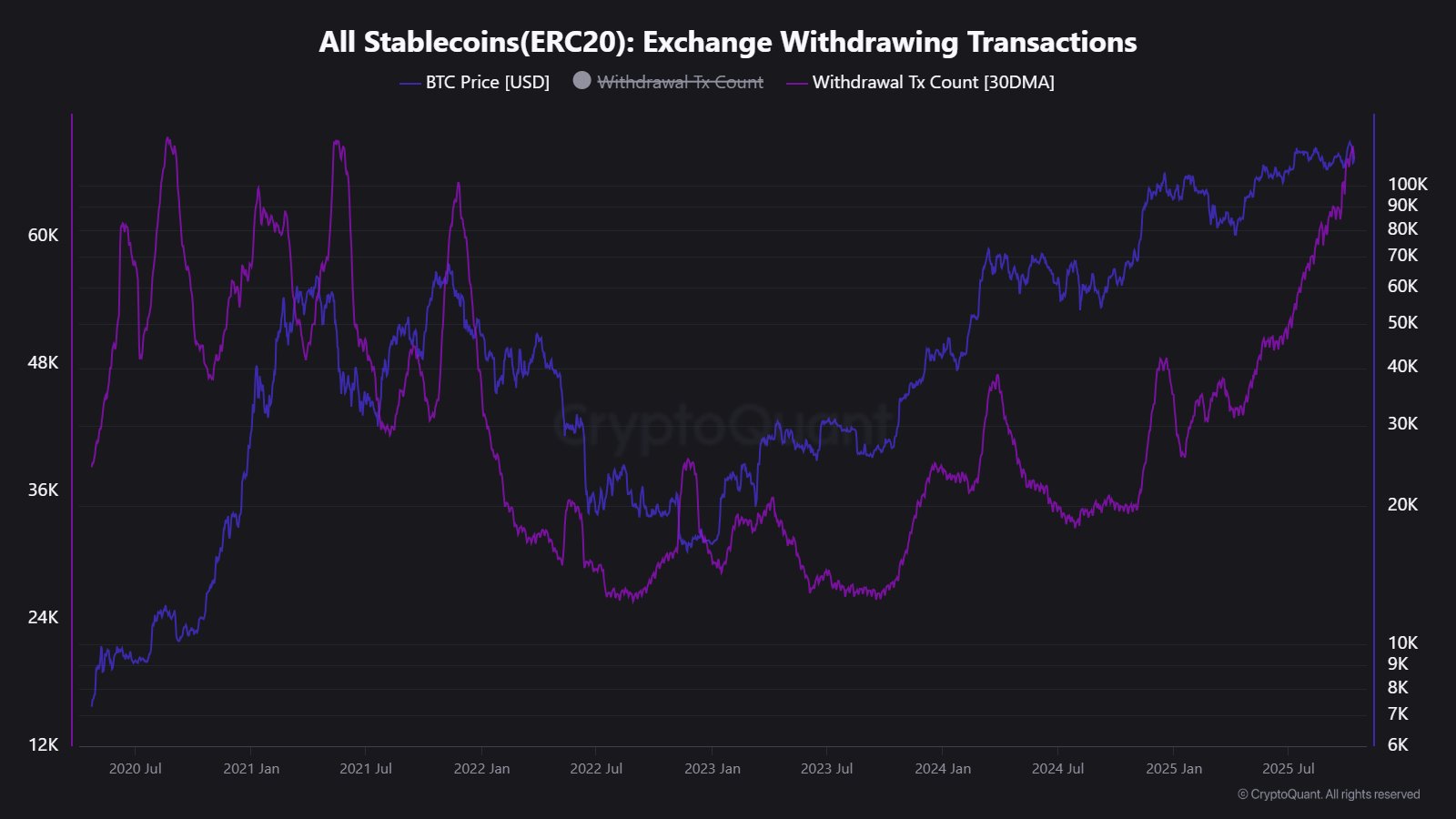

Now, here's a chart showing how the 30-day moving average (MA) of stablecoin exchange withdrawal transactions has fluctuated since 2020:

The 30-day MA value of the metric appears to have been climbing in recent months | Source: @JA_Maartun on X

As shown in the chart above, exchange withdrawal transactions for ERC-20 stablecoins have seen their 30-day moving average value follow a sharp upward trend recently. This indicates that an increasing amount of transfers are taking place to move stables out of the custody of exchanges.

If volatile assets like Bitcoin are included here, it will naturally be an upward trend for its price. But since the price of stablecoins is fixed around the fiat currency, buying or selling does not affect their price in the same way.

Alternatively, what investors do with the stables can have an impact on the volatile side of the market. When holders of these coins deposit these fiat tokens on exchanges, it may be an indication that they are looking to buy Bitcoin and other cryptocurrencies.

On the other hand, moving coins away from exchanges could be a sign that they want to keep their capital in the safety of stablecoins for some time.

After the recent rapid growth in stablecoin withdrawal transactions from the exchange, their value reached 67,384, the highest level since May 2021. This previous high occurred in May 2021 when Bitcoin holders sold for stables during the infamous crash of that month.

While the recent spike in the value of the gauge's 30-day moving average is exceptional in terms of size, it is still just the first spike in demand for stablecoin withdrawals in the current cycle so far. The previous session saw several spikes of the same size before the music stopped during the bull run.

Bitcoin price

Bitcoin witnessed another setback over the past day as its price returned to the $110,900 level.

Looks like the price of the coin has retraced its recovery | Source: BTCUSDT on TradingView

Featured image by Dall-E, CryptoQuant.com, chart from TradingView.com

Editing process Bitcoinist focuses on providing well-researched, accurate, and unbiased content. We adhere to strict sourcing standards, and every page is carefully reviewed by our team of senior technology experts and experienced editors. This process ensures the integrity, relevance, and value of our content to our readers.