Photo source: Getty Images

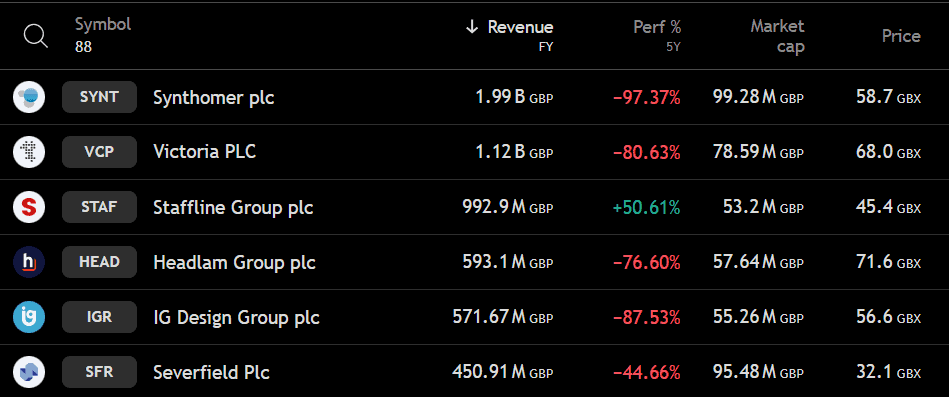

It is not customary to see a shark arrow that suffered heavy losses Synthomer (LSE: Synt). 97.37 % decreased in the past five years, the main supplier of hydrolysis has become one of the worst shares in the UK.

However, the company still attends approximately 2 billion pounds in the past year – more than any other Pence shares on the market. Once consisting of FTSE 250SYNTHOMER fell to Penny Stock last month after the market ceiling dropped to less than 100 million pounds.

In its results in the entire 2024, the group reported a net income loss of 72.6 million pounds -decreased sharply from the profit of 208 million pounds in 2021. And the latest results of the year 2025, which increased the worst, with the profit loss per share (EPS) of 26 pixels, compared to 2P profit expectations.

So what is the mistake that happened – and can it recover?

Years of prosperity and bust statue

SYNTHOMER story is one of the courses. In 2018, the company enjoyed a sharp increase in the demand for nitilin rubber (NBR), a major component of available medical gloves. The profits and acquisitions helped put the group as a global player for chemicals, giving investors confidence in the growth story.

By 2019, this momentum faded. The high costs of raw materials and the weakest demand in Europe and Asia have witnessed the profit contract. Then came in 2020 and the epidemic. Once again, the demand for the glove rose, which sparked another gathering.

But the boom was short -term. In 2020, omnova Solutions acquired the company with heavy debts. As the epidemic and demand for glove faded, Synthomer was left with high costs, low profits, and a public budget under pressure.

The shares, which are now trading about 58 pixels, have decreased by 98.5 % since September 2021 higher than 4000p. Investors who bought at the top have seen an unusual value that has been wiped.

Expansion and Malians

In October 2021, Synthomer bought Eastman Chemical adhesives for a billion dollars, which included a factory in the Netherlands producing about 80 different artificial resins. While the deal expanded the product base, it added to the debt pile.

Even, therefore, the public budget is not without merit. The group has 2.45 billion pounds in assets and 996.6 million pounds in property rights for 960 million pounds of debt. It also established 15.7 million pounds from the cash flow last year.

The administration is now focusing on reducing growth, and agreed to relief the covenant with lenders until 2026, which gives some breathing space. In addition, the free cash flow improved last year, and net debt has already decreased from the previous levels.

Can he recover?

Requirement depends on reducing the net debt ratio to EBITDA to a safer level. This may include selling non -basic assets, financing on better terms, or awaiting reduction in interest rates. Any sign of profit installation or debt reduction can pay the rejuvenation of the Synthomer share.

Personally, I think this shares are only worth looking at investors who have a strong appetite for risks. It can be a classic and highly risk transformation story.

But for me, heavy leverage, constant losses and unconfirmed total economic environment make her look very speculative at the present time.