Image source: Getty Images

UK stocks have done really well in 2025. Year-to-date, UK stocks have done really well in 2025 FTSE 100 index The index is up about 18%. However, gold has performed better. Currently, the precious metal is showing gains of about 50% year to date.

The question is: Which asset class will make more money in 2026?

Can gold reach $5,000?

Gold is in a strong uptrend at the moment. This is fueled by a combination of factors including huge government deficits, economic uncertainty, geopolitical uncertainty, lack of confidence in the US dollar, and fears that the independence of the US Federal Reserve could be jeopardized.

Many experts expect this trend to remain in place in 2026. For example, Metals Focus, a UK-based precious metals consultancy, recently predicted that gold will challenge the $5,000 per ounce level in 2026.

Other companies that mentioned $5,000 as a price target for 2026 include Goldman Sachs and JP Morgan. If it reaches this level, it would represent a profit of about 25% from here.

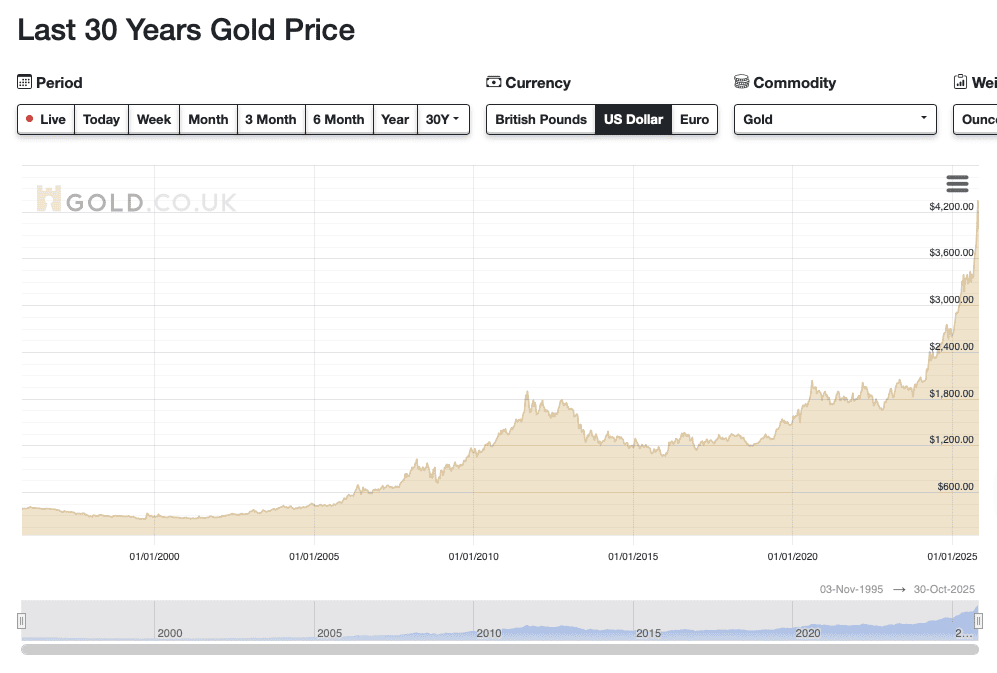

The thing is, while I completely understand why demand for gold is high right now, the commodity has seen a sharp decline recently. Looking at the 30-year chart, the price has become a bit “parabolic” recently.

History shows that these types of price movements are not sustainable. So I wouldn't actually be surprised if gold delivers disappointing returns in 2026.

Of course, with gold, there are no profits or income, so it is impossible to evaluate it accurately. So no one really knows how much it is worth.

UK stocks with strong potential

Moving on to UK stocks, the major indices here have had a very difficult performance recently. As I said above, the FTSE 100 is up 18% this year. This is a huge gain. The average return for this index over the past 20 calendar years is approximately 6.3%.

It's worth noting that a lot of the larger components of this index had a really strong year. For example, HSBCGained nearly 40% while Rolls Royce It reaches almost 100%.

I don't expect to see these kind of gains again next year. So returns from the index may be disappointing.

However, there are plenty of individual UK stocks that appear to have a lot of potential. An example here is London Stock Exchange Group (LSE: LSEG), which is now one of the world's leading financial data providers.

The market has underperformed this year and is currently trading at around £94. However, the average analyst 12-month price target is £124 – almost 32% higher.

Of course, broker price targets are just expectations. More often than not, it doesn't come to fruition.

However, in the case of this stock, I see a lot of potential drivers for the stock price including:

- Launching new AI products (developed using… Microsoft)

- Investors realize that AI is not killing their business

- A large share buyback

- Refocusing on “quality” in the stock market

- Valuation revaluation (currently trading at a low P/E ratio of 21)

Now, the stock is not bulletproof. There are risks related to customer spending, competition from competitors, and sentiment toward technology stocks.

I'm backing it to make more money than gold in 2026, and I think it's worth a look. Currently, it's my biggest stock in the UK.