Photo source: Getty Images

Looking for the best FTSE 250 All courses for purchase in September? Here are three shares in the middle of the square in the UK I think investors should look at it.

Defense hero

Driven by defensive spending in Europe, QINETIQ (LSE: QQ.) It is distinguished by the strong and continuous growth by the city's brokers.

The high bottom line is characterized by 18 % for this financial year (until March 2026). This leaves the company trading on the price ratio (P/E) from 15.7 times, and it is much lower than that FTSE 100 Like defense players BAE systems and Rolls Royce.

This also leaves QINETIQ shares on the P/E-To-To-Pott-Bott-Bott-To-Potth (PEG) of 0.9. This also means that the annual profits tend to jump by 8 % on an annual basis, leaving the profit distributions of 2 %.

Why is the company very cheap, ask? A warning in the month of March, when the company advised severe pressure in the United States, so investors were terrified because uncertainty is still on the defense budgets in Washington. This remains something that investors should monitor.

However, respectively, I think this threat is more than baking at the price of Qinetiq. I also think that, on the balance, the FTSE 250 defense expectations are very encouraging with the prosperity of European defense budgets. In fact, the company has achieved the standard levels of 2 billion pounds last year, with the help of its strong relations with the Ministry of Defense in the United Kingdom.

The emerging market star

Assad's financing (LSE: BGEO) was one of the most powerful FTSE 250 artists in 2025. However, it still provides an excellent comprehensive value, with the P/E front ratio 5.8 times and the return of huge profit distributions by 4.1 %.

The company's licenses, compared to other British banks, reflects their unique geographical mark. In addition to providing a major exposure to Georgia, It has a great process in Armenia and the smallest in Belarus. These areas are not strangers to political turmoil, which continues to this day.

But the fast pace where profits grow still makes Assad deserve a closer look, in my opinion. The operation fell 9.5 % between January and June, while the profit jumped by 28 %.

City analysts expect that the annual share profits will decrease by 18 % in 2025. However, this reflects exceptional gains in the year that preceded these distorted profits. In fact, the number of the number is expected to increase the number of impressive long -term growth story, driven by strong economic growth in its markets.

The bank on that

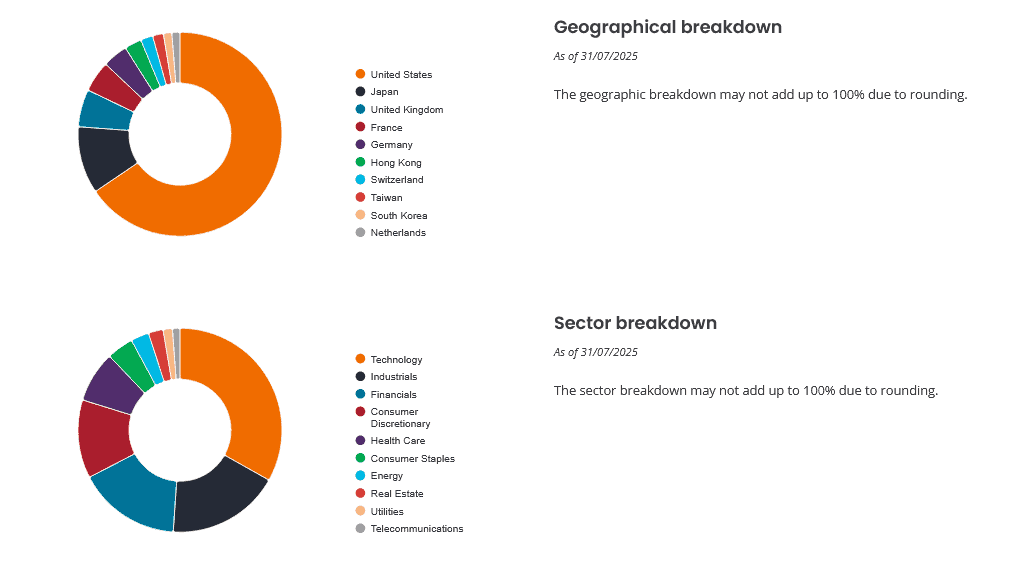

the Banking Investment Fund (LSE: BNKR) provides an investor way to target growth and income in much lower risk. As you can see, it contains shares in about 100 different companies from all over the world and different sectors:

This diverse approach protects the total returns from the individual, industry, or regional shocks. Funly, this did not come at the expense of revenue – since 2015, has been provided with an annual average annual return of 11 %.

This is almost twice the return that the broader FTSE 250 was delivered at the time.

Bankers achieved this through a set of capital profits and entered profits. In fact, the annual profits here have increased every year for more than 50 years. This is despite the high translation of technology growth shares, which can affect revenues during economic shrinkage.

Today, confidence is traded by 9 % discount on the net asset value (NAV) per share. This makes it worth serious attention, in my opinion.