Photo source: Easyjet plc

The subsequent recovery of the travel industry has exceeded even the most optimistic expectations. The strong and continuous demand for the plane tickets paid the prices of shares of many shares of airlines across the ceiling. Easyjet (LSE: EZJ) 31 % shares have risen over the past three years.

But the signs of weakness appeared recently. After a profit warning on Thursday (July 17), the price of Easyjet shares now decreased by 11 % since the date of 2025.

Bright price expectations

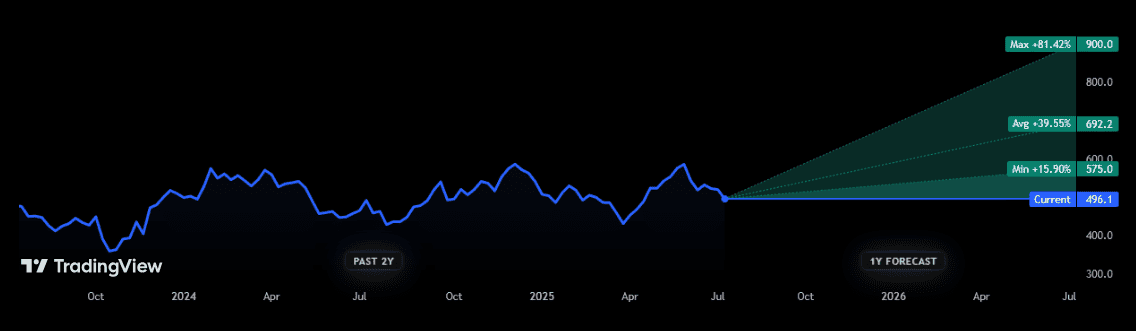

However, the city’s expectations indicate that the recent price problems in the budget will not prove anything more than temporary disorders. Seventeen analysts currently on classifications on FTSE 100 a company. They unanimously believe that the value will rise over the next 12 months:

The consensus point of view is that Easyjet will rise approximately 39.6 % in this period. If this is accurate, the shares will be of 10,000 pounds today, 13,960 pounds. Add profits, and the total return will be higher (Easyjet arrow bears a healthy return 2.9 % today).

Looking at stock licenses, on paper, it can have a great room for apostasy. The ratio of its price is 6.9 times, one of the lowest rates in the sector.

What’s more, the ratio of the price to the book (P/B) is only 1.4. It is higher than the value of the aquatic mark for one, which indicates that it is circulated in a simple installment of its assets. But it is still less than average of 10 years of 1.7 times.

Profit warning

All this, I am not convinced of Easyjet’s ability to rise sharply. I also feel that the evaluation of the cheap airline reflects many of the challenges it faces in the short term and beyond.

My fee was confirmed by warning unpopular profits today. In that, the company said. “Modern high fuel costs and the size of industrial procedures by monitoring French air traffic in July“Will the profits of the entire year be praised to 25 million pounds?

Airport and air infrastructure disturbances are long -term threats to the aviation industry. Easyjet is particularly vulnerable, given that most of its destinations are in Europe where such disorders are common.

The problem of flying fuel costs is equal and not less important. Nearly 30 % of the expenses of the airline are linked to fuel.

On the positive side, the demand for Easyjet aircraft tickets and the package holidays continues to rise steadily. The group rotation rate increased by 10.9 % between April and June, and pre -tax profit increased by 21.2 %.

However, he also said that the last trend of vacationers who take time to reservations have continued. Could this be a sign of weakening the traveler’s appetite while continuing crises of the cost of living?

Clear

For these reasons, I do not tend to buy Easyjet shares despite the expectations of bright arrow prices for the city’s analysts.

After today’s update, the Panmure LibeUM reduced the 12 -month price forecasts to 730 pixels per share from 800 pixels, which is one of the many cuts by the city analysts. I am afraid that there will be more upcoming discounts and the shares of FTSE 100 can drive sharply from today’s levels.