Photo source: Getty Images

A monthly monthly income without working for him looks great. But realistically, the matter will take 480,000 pounds in an investor in the stock market in order to earn 2000 pounds per month as a second income. It is designed to have an invested portfolio in stocks or bonds that collectively provide 5 % returns.

Of course, unless it is completely planned, it is unlikely that these shares will offer 2000 pounds every month. Arrows usually pay their profits once or twice a year, and this may lead to more investors in some months or less in others.

However, the road to achieving 24,000 pounds annually is realistic. It is not just part of a rich diagram. This takes some time and perseverance.

Starting from scratch

So what is the formula? Well, it takes a potential investor to open the shares and sharing ISA through any major UK mediation. This part is simple. After that, they will need to adhere to a regular contribution to this account. In this case, 500 pounds will be perfect per month.

Many beginners begin to invest in money that seeks to track the performance of global shares or specified indexes. It can be said that this is the lowest way to invest in the stock market.

However, some investors may seek to overcome the market. This will be possible to invest in a more selective group of shares with possible assessments or overlooking them.

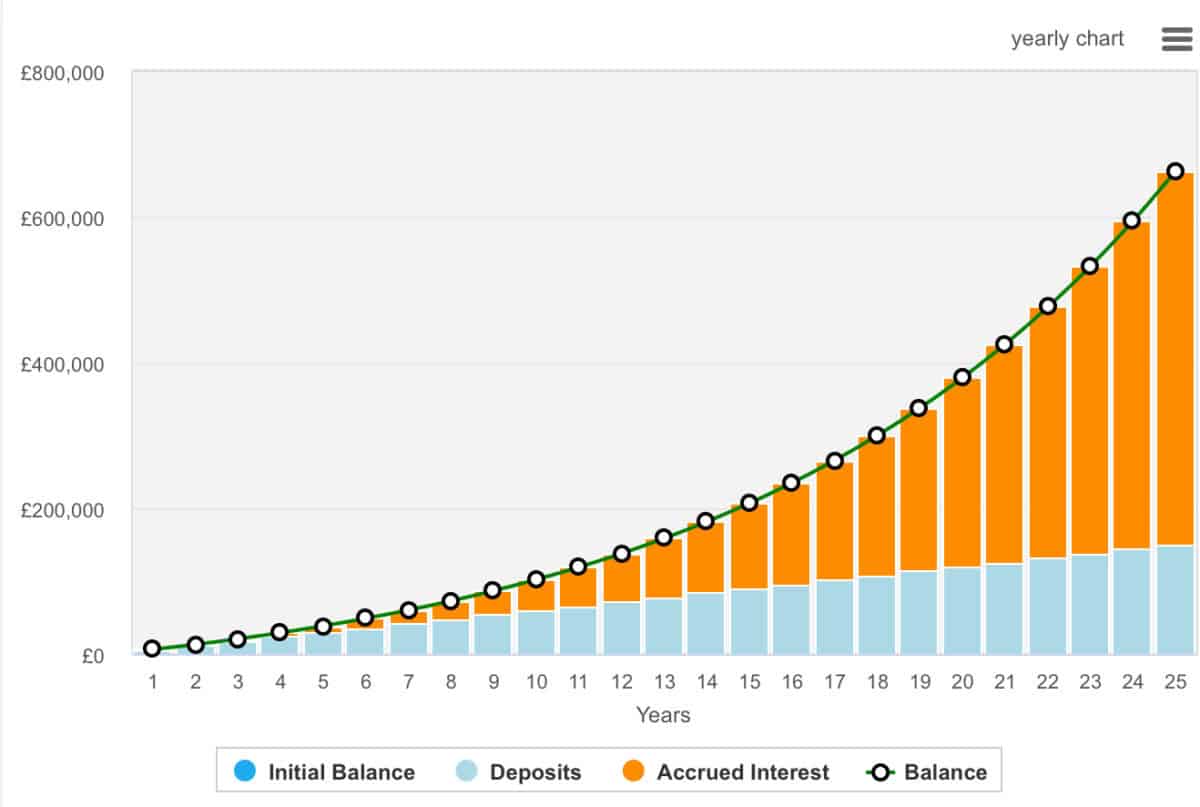

An experienced or enlightened investor may seek to achieve an annual return of 10 %. Take advantage of these 500 pounds monthly contributions, the investor can convert an empty portfolio into a value of 480,000 pounds in a little more than 22 years. Here is how to run.

What’s more, when it is achieved in the stocks and ISA shares, everything is protected from the tax. There are no capital gains to slow our wallet growth and no income tax to distribute our profits.

Investors simply need to realize that bad decisions can lead to the loss of their money.

Please note that the tax transaction depends on the individual conditions of each customer and may be subject to change in the future. The content in this article is provided for information purposes only. It is not intended to be, nor form any form of tax advice. Readers are responsible for carrying out their due care and obtaining professional advice before making any investment decisions.

Investment to overcome the market

Confidence of the Scottish mortgage investment‘

Managed by Baillie Gifford, Trust invests in sabotage industries such as artificial intelligence (AI), electric cars (EVS), digital platforms, and choosing companies that have the ability to reshape their sectors.

This approach includes both public stocks and private companies such as Spacex, with a long -term and long -term investment horizon.

It takes confidence in a global perspective, unrestricted by geography or sector, allowing them to support companies that represent the future of their industries wherever they are. While it reduced its exposure to China, confidence in investment continues in the world.

However, investors should be careful that confidence practices are preparing (borrowing for investment). Although this can help confidence in building its wallet, it arrogates the losses when the market goes to the opposite direction.

However, its aspiration -heading strategy is to explain its historical ability to outperform international standards. This is why it is an essential part of my province and my daughter. I fully think it is worth thinking.