The strategy has just added to the Bitcoin purchase with billions of dollars in a purchase, which is its largest purchase since November last year.

The strategy bought another 21,021 bitcoin

The head of the strategy, Michael Celor, announced in the X Publishing, the company has completed a new acquisition of bitcoin. With this purchase, the strategy added 21,021 BTC to its holdings at an average price of $ 117,256 per code.

The purchase of $ 2.46 billion was funded using revenue from the first general offering of the company (IPO) of the changing interest from the preferred A Paretual Stretch (STRC) chain. This public subscription, which includes 28,011,111 shares, is the largest in the United States in 2025 so far. The strategy said in the press statement:

Once it is included on the Nasdaq Stock Exchange, STRC will be the first favorite security listed on the American Stock Exchange issued by the Bitcoin Company to the Treasury to pay the monthly profit distributions, and we believe, the first lasting safety in the American list to integrate the policy of the specified monthly profit distribution.

In the aftermath of the latest acquisition, the company’s BTC reserve grew to 628,791 BTC, at an average cost of $ 73,277 per code or total investment of $ 46.08 billion.

MAARTUNN, a Cryptoquant community analyst, shared a plan in the X Publishing Putting, putting the new purchase scale in a perspective against the past.

Looks like the buy is one of the largest during the past year | Source: @JA_Maartun on X

As visible in the graph above, the latest acquisitions are the largest in the strategy since November 24, about eight months ago. At that time, the company made a huge purchase that was more than twice the new purchase at $ 5.43 billion. Earlier in the same month, Michael Celor has completed a purchase that was also larger than the current version, this time worth approximately $ 4.59 billion.

At the current exchange rate, the value of Bitcoin Bitcoin in the strategy is estimated at about 74.04 billion dollars, which reflects a profit of $ 27.96 billion or about 60.6 %. Thus, the company’s reserves are in comfortable condition at the present time.

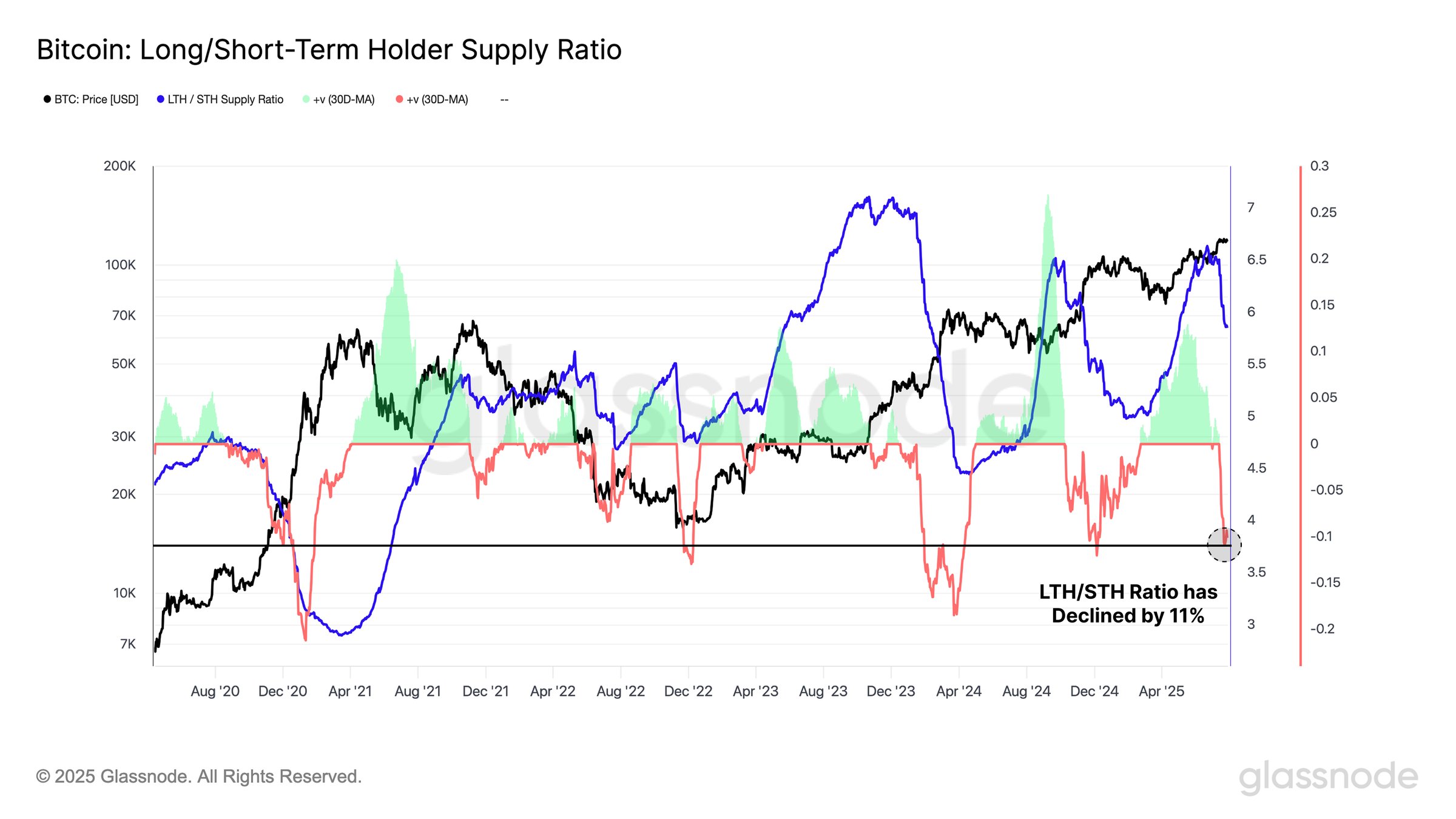

While the strategy continues in Hodl, it seems that other powerful hands have seized the sale, as Glassnode indicated the set of analyzes in the X.

The trend in the supply ratio of the short-term holders and long-term holders | Source: Glassnode on X

The above chart shows the percentage between the offer that the two main companies of the Bitcoin Market: short -term holders and their long -term holders (LTHS). Investors who bought their coins in the past 155 days are placed in Sths, while those who occupied this threshold belong to LTHS.

From the graph, it is clear that the percentage has witnessed a major negative change by 11 % during the past month, which means that the capital rotation occurred from the hands of diamonds to Sths. “This previous ATHS style has already highlighted a constant structural shift in the location of the investor,” note Glassnode.

BTC price

At the time of this report, Bitcoin floats about $ 117,800, a decrease of 1 % over the past 24 hours.

The price of the coin seems to have been moving sideways during the last couple of weeks | Source: BTCUSDT on TradingView

Distinctive image from Dall-e, Glassnode.com, Cryptoquant.com, Chart from Tradingview.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.