Photo source: Getty Images

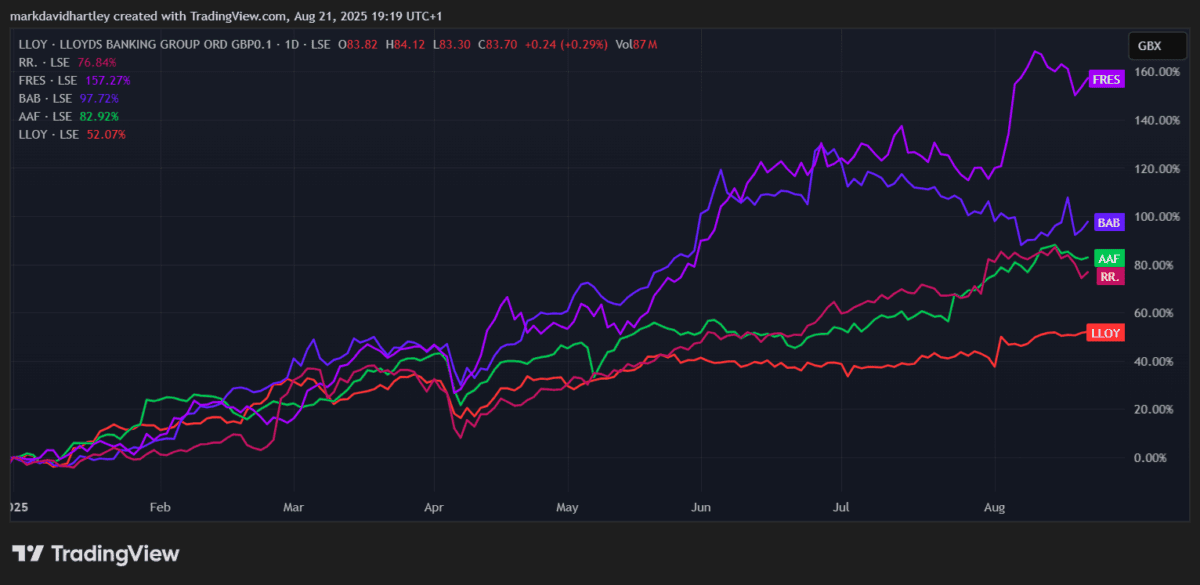

LloydsThe shares (LSE: LLO) continued to climb, which apparently climbed this week, achieving its total gains throughout the year by 54 %.

Only a handful of FTSE 100 Stocks work better, including Freissiloand Babakukand Aartel Africa And popularity Rolls Royce. Among the banks, Lloyds leads the package. Natest and Barclays About 40 % increased, while Carted Standard 37 % increased and HSBC 24 %.

This is the completely shift to the bank, which has not been widely considered widely considered as poorly sequenced.

Fast train?

RBC Capital Markets has recently marred European banks.SpeedIn a research note. This looks exciting, but analysts also highlighted the weakness of this sector in geopolitical shocks and the macroeconomic economy. Deutsche Bank and OSB Group.

Goldman Sachs It also took a more upward position, raising its target price on Lloyds shares to 99p of 87p earlier this month. On average, 18 analysts now believe that the stocks are heading to 90.7 pixels during the next year – about 8 % higher than the day. Eleven analysts have a strong purchase classification, while eight par excellence is committed.

Confidence seems to be greatly returned.

PayPoint Partnership

Another promising development is the news of Lloyd’s partnership with PayPoint. through Banks The service, the group’s clients will be able to soon work cash deposits in more than 30,000 sites throughout the United Kingdom.

This means simple and comfortable access to payment of up to 300 pounds per day in notes and coins, while showing money in accounts within minutes. More importantly, Lloyds will be the first high street banks to adopt the entire scheme.

In an era in which bank branches are closed at a record pace, the smart step appears to help maintain customer loyalty.

Trusted income … now

Income remains an important reason to buy many investors LLOYDS shares. However, the last gathering has paid the profit return to less than 4 % for the first time in nearly three years.

Still, stocks grow. Expectations indicate that batches may reach 4.7 pixels per share by 2027 – an increase of 48 % over 3.17 pixels today. It is not bad at all, although history shows caution. When Kovid hit, Lloyds cut his profits in half. If a similar shock fades, shareholders may face the same disappointment.

Interest and inflation rates are still risk factors. The sharp change in any bank profitability may lead to severely.

Is still a good value?

All this growth was not noticed by anyone. Lloyds price ratio (P/E) is now on 11, which is higher than NatWest, HSBC and Barclays. Debt to property rights is also significantly higher than most of its peers.

This indicates that Lloyds has no longer the deal that was one day. But although the best gains can be already in the bag, I do not expect the growth story to fade overnight.

For long -term investors, LLOYDs still choose FTSE 100 attractive to consider. The evaluation is no longer cheap for dirt, but with profit distributions, it is scheduled to rise and new services such as Paypoint Partships add value, there is still a strong condition for this British banking giant.